It became abruptly apparent in September, when overnight repo rates surged to near 10%, that liquidity in the banking system had suddenly become insufficient. While a confluence of factors (corporate tax payments, settlement of Treasury auctions, etc.) ultimately tipped the secured funding market into imbalance, it was policy choices—monetary and regulatory—that unwittingly pushed this market to the brink of illiquidity.

Monetary policy framework

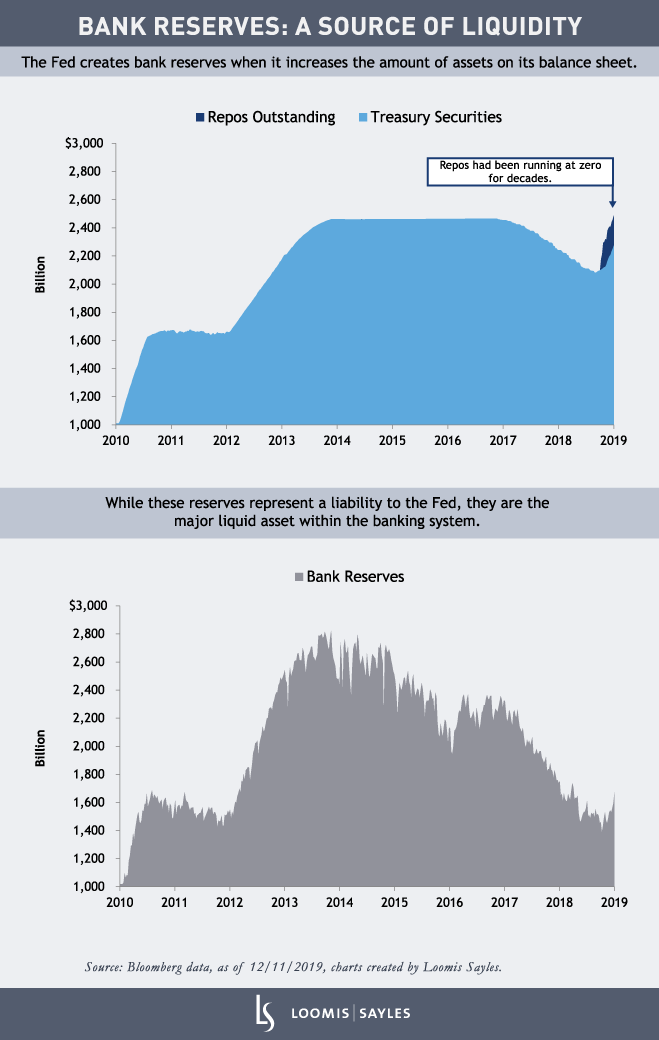

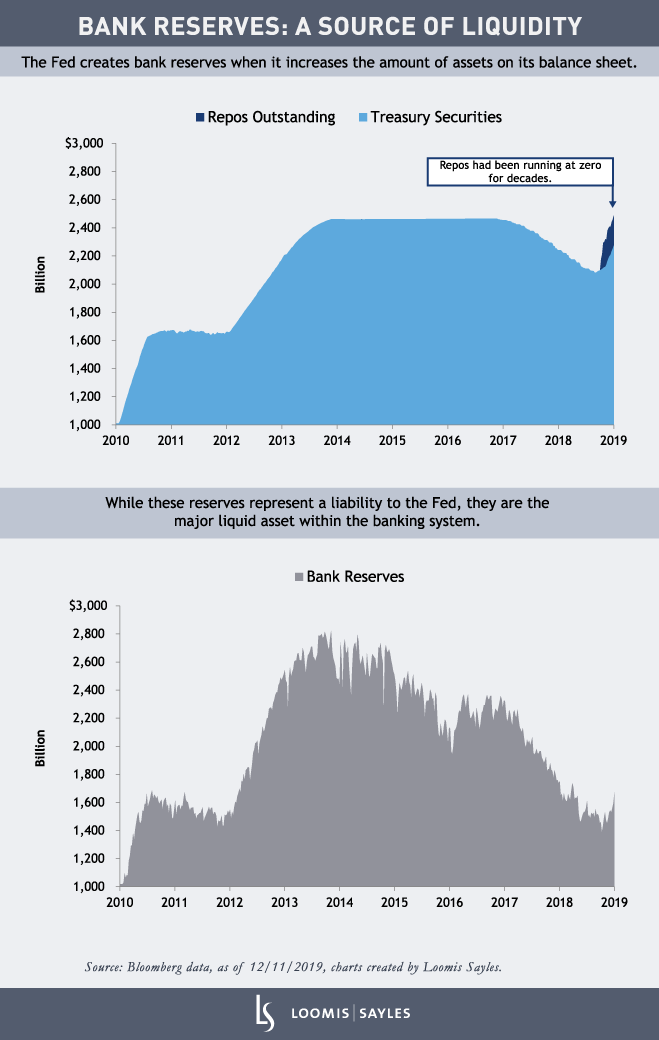

Since 2008, the Federal Reserve (Fed) has been conducting monetary policy via a “floor” operating system that sets the lower bound for market interest rates (the “floor”) by paying interest on bank deposits held at the Fed (bank reserves). This system doesn’t have an effective facility to cap market rates. Rather, an abundant supply of bank reserves is necessary to provide downward pressure on market interest rates.

The inconvenient truth

In the fall of 2017, the Fed judged that aggregate reserves were more than abundant. Eager to “normalize” monetary policy, the Fed began reducing its balance sheet to a size no larger than necessary to effectively and efficiently implement monetary policy. But complex regulations layered onto the banking system post-GFC made it difficult to judge when reserves might begin to become scarce. And because the demand curve for reserves is non-linear, there is no warning as you approach this inflection point. There is no check engine light, the engine just starts to malfunction, which is what happened in September.

Repo market dynamics

Reserves, when abundant, can be a source of funds for the repo market. The Fed’s balance sheet contraction was reducing this potential supply as demand for repo funding was not only trending up, but also becoming increasingly concentrated at the overnight point. This amplified the effects of this sudden imbalance as those reliant on funding in overnight markets don’t have the luxury of waiting for the price (funding rate) to align with their perception of fair value. Because overnight funding markets must find an absolute clearing level every day, imbalances are resolved via an abrupt adjustment in the market price (repo rate).

Fed actions: treating the cause, not the symptoms

The dysfunction in September brought to light various frictions within funding markets. But these frictions only became constraining factors when liquidity became scarce. The Fed addressed the problem by initiating open-market operations aimed at quickly rebuilding reserves in the system. It added about $200 billion in reserves on a temporary basis via overnight and term repos. In addition, the Fed began rebuilding permanent reserves via Treasury bill purchases at an initial pace of $60 billion per month. The Fed has stated that temporary operations (repos) will remain in place at least through January 2020, while permanent operations (Treasury bill purchases) will continue at least into the second quarter of 2020 (with an open-ended commitment to reinvest proceeds at maturity).

No quick fix

Keep in mind that the Fed’s open-market operations rely upon Primary Dealers[1] to act as counterparties. While these dealers tend to act primarily as agents in permanent operations (Treasury bill purchases), temporary operations (repos) are entirely dependent upon the use of Primary Dealer balance sheets in distributing liquidity throughout the system. Regulatory constraints on these balance sheets will likely limit the potential effectiveness of these temporary operations.

With continued reliance on temporary operations, I expect another period of acute tightness going into year-end. More generally, I expect moderate tightness in funding markets to persist until permanent operations can restore reserves to a sufficient level, possibly in the first quarter of 2020.

But no permanent damage

Do not confuse periodic flare-ups as signs of persistent systemic deficiencies. It may be an uneven process, but it appears repair is underway. Temporary operations should soon be supplanted by more effective permanent operations. After an initial stumble, I’ve been impressed with the Fed’s actions. When considering the issue of systemic liquidity, what matters most is the central bank’s attentiveness and willingness to act.

[1] Primary dealers are trading counterparties of the New York Fed in its implementation of monetary policy. They are also expected to make markets for the New York Fed on behalf of its official accountholders as needed, and to bid on a pro-rata basis in all Treasury auctions at reasonably competitive prices. Source: newyorkfed.org.

MALR024656