While the markets in the first quarter may have been roiled by a former antagonist—volatility—the outlook for the rest of the year looks solid. Global growth is projected to continue, fortified by strong corporate earnings estimates—particularly for US companies, where tax cuts should boost bottom lines. But changes in US monetary policy and global trade rules are on my radar as potential risks. Here is a snapshot of my outlook.

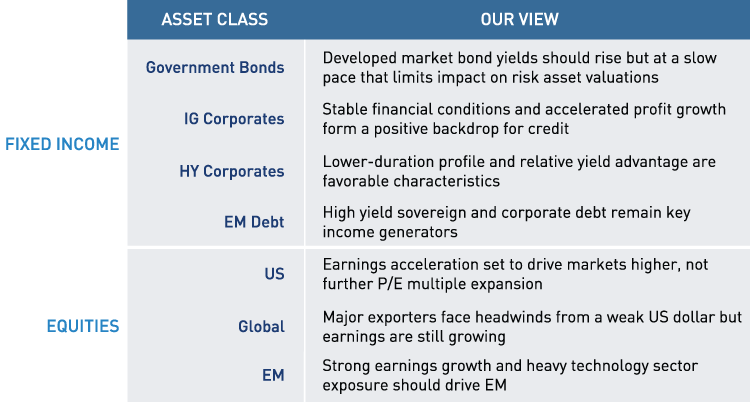

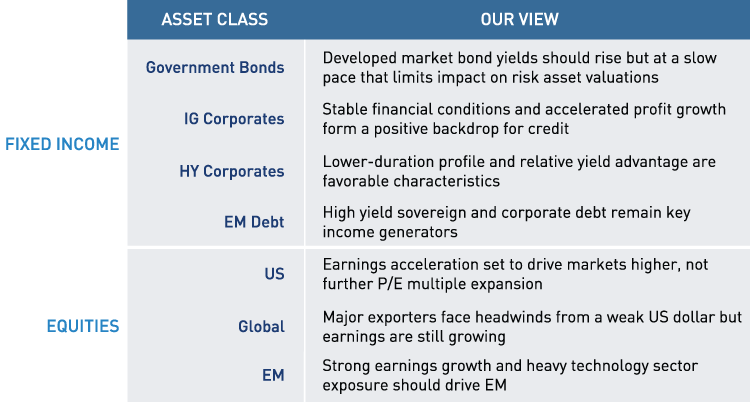

Macro picture: Continued strength in economic indicators like GDP growth and consumer confidence has many investors monitoring the rate of inflation and Federal Reserve signals on monetary policy. So far, better domestic economic activity has been met with rate hikes, a trend that we see continuing, but at a fairly slow pace that should not disrupt risk assets.

Credit spreads: Credit spreads are at multi-year lows and are less likely to tighten further as the cycle advances. However, narrow credit spreads can remain narrow if financial conditions are stable. In an environment like this, lower-duration sectors of the credit market, such as high yield and asset-backed securities, may perform better than their longer-duration counterparts. Floating-rate bank loans should also continue to attract investor demand as rates gradually tick up.

Emerging markets & non-US dollar: Taking a 30,000 foot view of capital flows, investors have been opting for the prospects of non-US markets and assets as they seek better growth opportunities and investments with greater total return potential. This environment has fostered a weaker US dollar, and with a dollar bull market largely absent, local-currency EM debt looks particularly attractive given the relative yield advantage.

Equities: Global growth optimism and supportive financial conditions led to outsized gains in the equity market in January. While volatility picked up by quarter-end, prospects for global equities in the quarters ahead also improved. From an earnings-per-share standpoint, we believe the S&P 500® Index is likely to show year-on-year growth of nearly 20% for 2018, and EM earnings could be nearly on pace with the US. With positive earnings growth, equities should find valuation support and a basis for potential gains. Price-to-earnings multiple expansion looks less likely.

Risks: If US inflation and interest rates move higher and faster than we expect, aggressive Fed tightening could lead to a flat or inverted yield curve and a premature end to the cycle. Globally, financial tightening and regulatory clampdown in China could be disrupters, as could global trade wars and tariffs.

MALR021636