By Laura Sarlo, Senior Sovereign Analyst and Julian Wellesley, Senior Global Equity Opportunities Analyst

Fans of the “Fast & Furious” movies know the game of chicken. Two cars race toward each other, each driver waiting for the other to swerve out of the way. If neither swerves, the cars collide head-on. This game has been playing out in Europe as the UK and Italian governments each face off with the European Union (EU).

Let the games begin

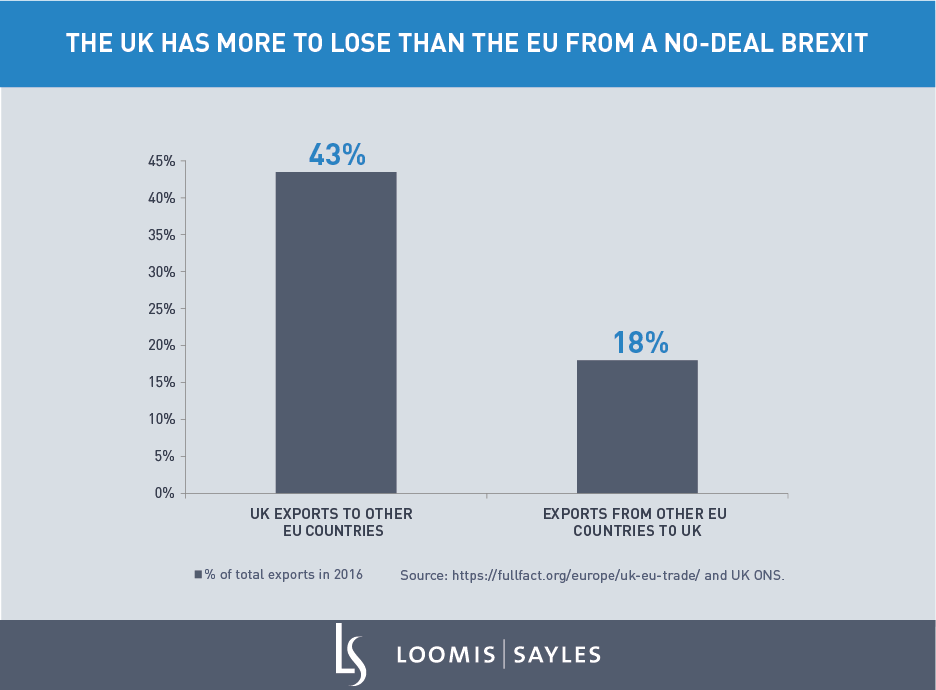

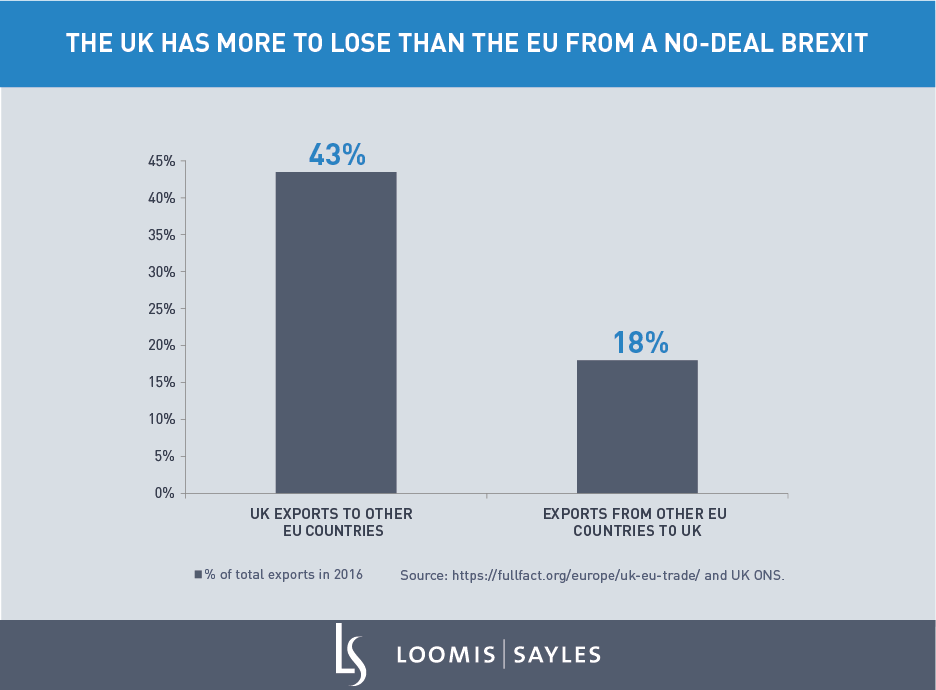

The clock is ticking on the UK’s exit from the EU; the deadline is in March 2019. The UK and EU are risking severe business disruption if they don’t reach an agreement in time. Ever since the Brexit vote in June 2016, UK Prime Minister Theresa May has been unable to form a unified negotiating position, even within her own party. Fears of a no-deal Brexit are rising. We believe an agreement will be needed by January 2019 at the latest in order to pass legislation before the deadline. Given its relative economic size and trade links, the UK’s economy would likely take a bigger hit from a no-deal Brexit than the EU. We believe the UK is likely to swerve first.

The EU is playing another game of chicken with the new populist coalition government in Italy. Italy is antagonizing the EU in many different policy areas. In its upcoming budget proposal, Italy may threaten to violate EU budget rules by sharply increasing government spending. This proposal could undermine Italy’s long-maintained primary budget surplus, which is a key pillar of the country’s credit ratings. The government has failed to propose structural reforms to help increase Italy’s long-run potential growth rate. Instead, they are prioritizing social spending by pledging a guaranteed minimum income, rolling back prior pension reforms and instituting a “flat-tax” system. Investors were already unnerved by the anti-euro rhetoric of some of the government’s economic advisors. Now they’re getting spooked by proposals that are likely to add to Italy’s already high government debt burden.

Who swerves?

In the game of chicken in the movie “Furious 7,” neither driver swerves and the two cars collide. The crash destroys both cars, but somehow Jason Statham and Vin Diesel emerge from the wreckage to glare at each other. In reality, the consequences of a head-on collision are usually much worse. But more importantly, one driver almost always swerves. And it’s typically the one who has most to lose. We think the UK will swerve away from a no-deal Brexit. Will Italy swerve too? It’s not so clear. In our view, Italy is too big to fail and too big to bail, so they’re likely to avoid a head-on collision this time.

European games of chicken have already weighed on financial markets this year— Italian bond yields have risen, European bank stocks have sunk and the British pound exchange rate has languished—and this pressure is likely to continue. Even if these current games with the UK and Italy get resolved, it probably won’t be long before another game of chicken begins. Financial tensions in the euro zone are like the “Fast & Furious" movies—the sequels keep coming.

MALR022400