What do you get when banks consolidate, capital requirements escalate, lending standards rise and corporate lending arms shrink? You get non-bank lenders and business development companies (BDCs) helping to fill financing needs.

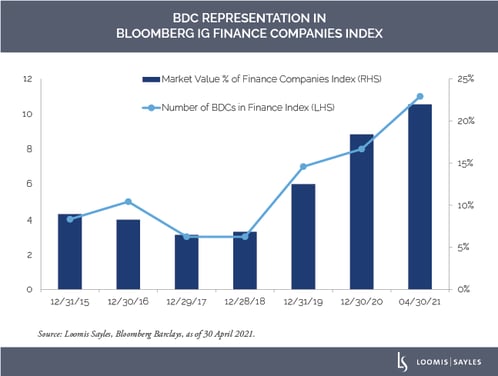

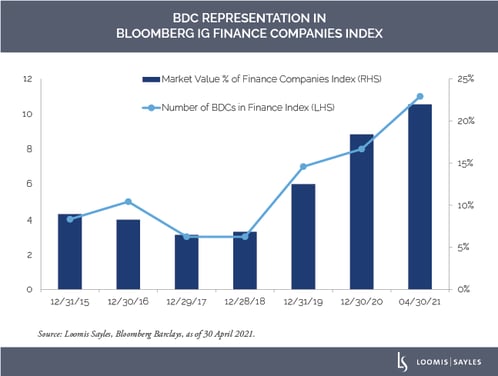

While becoming a financing option, BDCs have also emerged as an investment option—albeit one getting little attention in our view. Could BDCs follow a growth path similar to REITs? We think so.

What is a BDC?

BDCs are finance companies that lend to the middle-market segment. Increasingly, they are seen as an important part of the leveraged finance markets servicing middle-market companies.

Looking Forward

For investors able to gauge the market landscape and identify more established players, BDCs could be an investment worth consideration.

We expect BDCs to claim a larger representation in the unsecured markets. The availability of private equity capital should continue to fuel trends toward privatization and buyout activity in the middle market. This could result in demand for BDC financing of new loan activity. Additionally, with growing capital to lend, we could see BDCs continue to expand their stakes in larger deals that may previously have gone to the syndicated loan or high yield markets.

To learn more about how BDCs work, their role as lenders in the middle market and future risks they may face, read the full paper:

MALR027701

Any investment that has the possibility for profits also has the possibility of losses, including loss of principal.