By Harish Sundaresh, Portfolio Manager, Systematic Investing Strategies, Michael Frederikse, Technology Partner, and Thomas Dunlap, CFA, Investment Analyst

It can be difficult to give a fair representation of each country’s market response to the COVID-19 outbreak. Each nation has varying initial conditions, population responses, and approaches to quarantines. Some countries have not issued a formal quarantine order, yet many people may have chosen to quarantine anyway. How can one measure a country’s response under these circumstances? We believe high-frequency data can offer some answers.

Groceries: a leading indicator for quarantine start dates

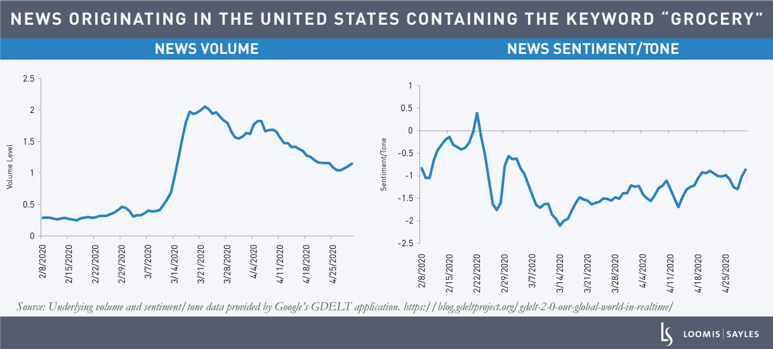

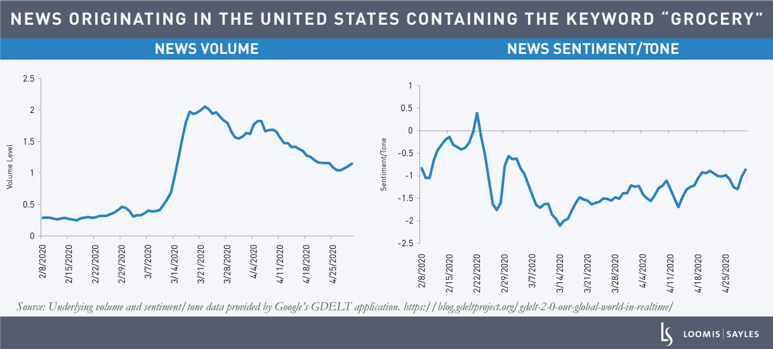

We looked at global news volume and sentiment surrounding “food” and “groceries,” and found that these metrics gave us insight into when populations truly began to follow quarantine procedures.

The chart below shows the volume (left, in blue) and sentiment (right, in blue) of news originating in the United States containing the keyword “grocery.” The underlying theory is that as pressure to quarantine grows—either through social means or through government lockdowns—so will the concern for essential items like food and groceries. Thus, the keyword “grocery” could be a leading indicator for quarantine start dates. The US experienced a clear inflection point in both volume and sentiment on March 14, 2020. This date is likely very close to the date most Americans began to quarantine, as they prepared to stay home and stocked up on groceries.

Once we determine a country’s “grocery outbreak” date, we can examine the subsequent trend in grocery queries. Comparing this information with that of other economies, we can project the current slope forward to estimate when a country may be able to start reducing the intensity of quarantines.

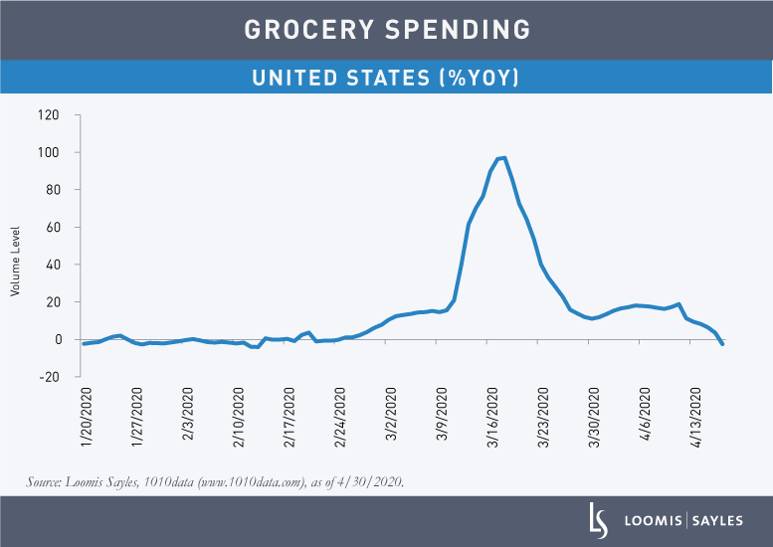

Consumer spending patterns

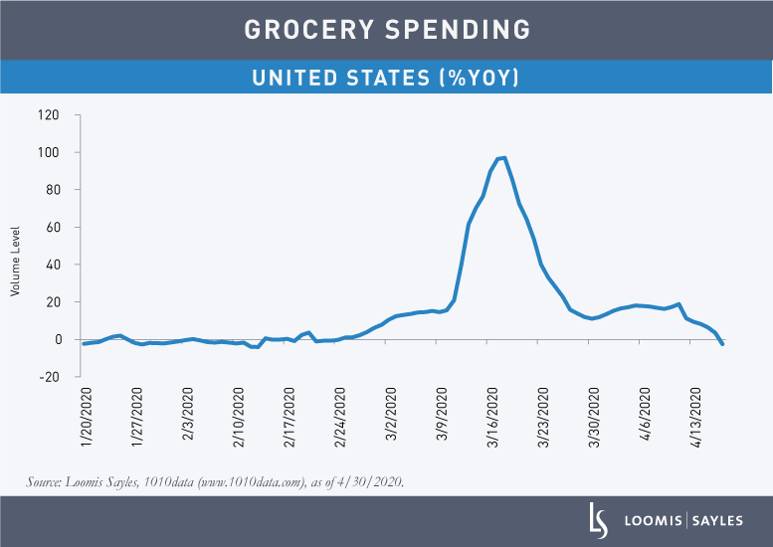

We’ve also been watching a complementary measure of the “grocery” outbreak: consumer spending, arguably among the purest forms of behavioral data. US consumer spending on food and groceries noticeably spiked at about the same time grocery query data surged. Year-over-year sales accelerated from a mid-single-digit run rate in the last week of February to almost 100% in mid-March as people hoarded items like toilet paper and sanitizer. The rush was a direct reaction to shortages of similar items in China and other countries with preceding outbreaks. Since then, spending has fallen in line with last year’s numbers.

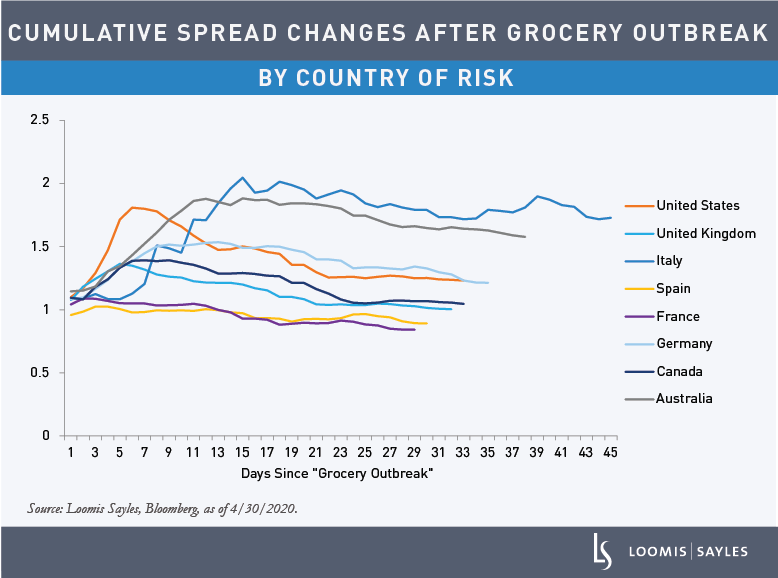

A new lens for viewing market reactions

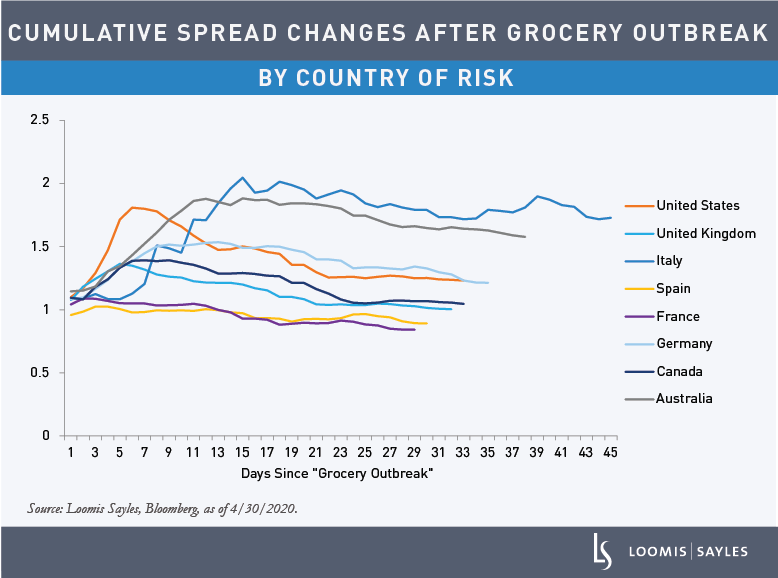

As market volatility grew, these alternative data signals provided a consistent understanding of each country’s COVID-19 timeline. Identifying the “grocery outbreak” dates for each country gave us a new lens for viewing each country’s market reaction to COVID-19. We plotted the cumulative spread changes after the grocery outbreak date for each of the major developed markets within the Bloomberg Barclays Global Aggregate Index. We found that most developed market countries experienced a sharp widening in spreads followed by a slow compression toward pre-outbreak levels as central banks flooded the markets with liquidity.

Governments, industries, and people around the globe are continuing to feel the impact of COVID-19. Markets tend to be forward-looking. We believe tracking panic, news sentiment, and spending patterns can help investors track patterns across geographies and identify relative value opportunities in countries that appear to be gaining control of the situation.

MALR025444

Commodity, interest and derivative trading involves substantial risk of loss.