The burning question for equity investors is: what will happen to earnings in 2017? We estimate that aggregate operating S&P 500 earnings will grow in 2017 at a mid-single digit clip, if not better. This takes into account our constructive economic forecast and expectation that commodity sector earnings will show some improvement. We fully expect that 2017 will be the first year of meaningful operating EPS growth since 2014.

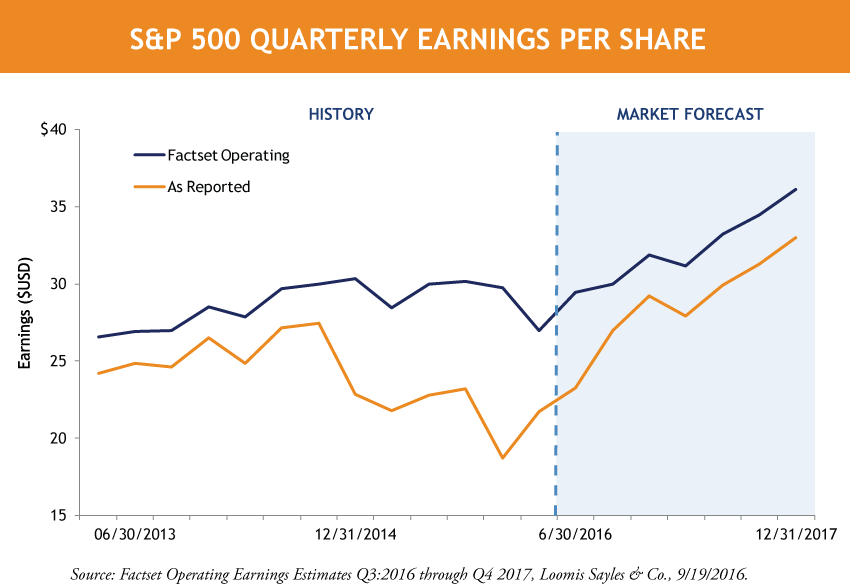

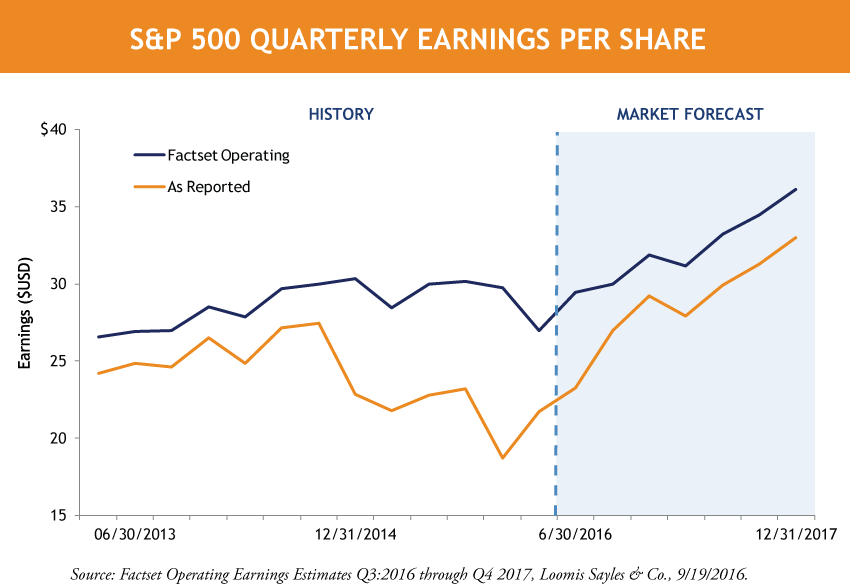

Since mid-2014, S&P 500 reported earnings (using Generally Accepted Accounting Principles -- GAAP) have fallen considerably. GAAP earnings for the S&P 500 in Q3 2014 were about $27.50. Over the next 12 months, sharply declining commodities prices led to the S&P 500 reporting GAAP earnings of only $18.70 in Q4 2015. With the recent stabilization in commodity pricing, earnings have begun to recover, moving above $23.00 in Q2 2016. And we think more improvement is on the way.

Focusing exclusively on GAAP earnings tends to lead to an overly negative view of the earnings cycle. Let’s examine earnings another way. Adjusted operating earnings, as reported by Factset, paint a far different and more favorable picture. The main difference is that adjusted earnings treat “special items” as one-time in nature, adding back the negative items. Adjusted operating earnings tend to average about 10% above GAAP earnings in “normal” times – which was more or less the case in 2013 and 2014. In Q4 2015, however, adjusted earnings of $29.72 were a whopping 58% above the level of GAAP earnings of $18.70.

This is seen in the following chart:

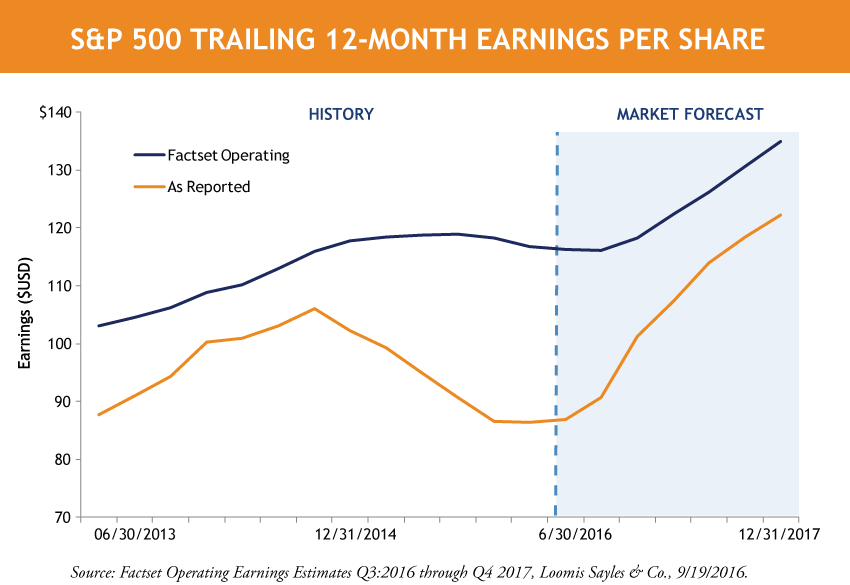

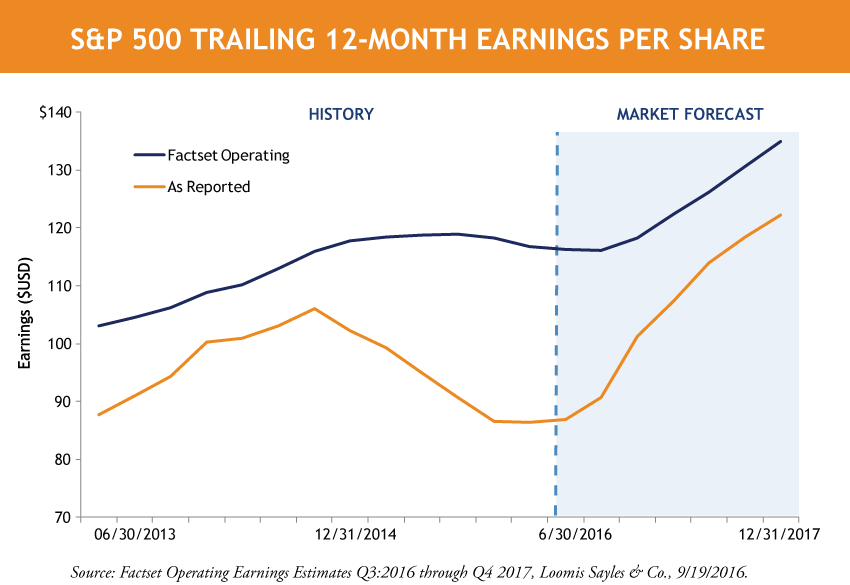

On an adjusted operating earnings basis, it appears that by the end of this year, we will have experienced three flattish years in a row. As you can see below, adjusted operating earnings were $116.76 in 2014, $117.29 in 2015 and are expected to be about $118.00 in 2016.

In past years, the energy sector has contributed more than 10% of total index earnings. In 2016, earnings from the energy sector will barely be positive and growth in other sectors has continued, offsetting the weakness. Most sectors, other than energy and materials, have continued to report positive earnings growth over the past three years. We believe that even energy will post earnings growth in 2017, albeit from a low base.

The chart below shows the earning results on an annual basis. Earnings should begin to move higher next year. While the chart depicts “bottom-up” consensus, which is very likely to prove to be high, mid-single digit growth should be achievable if the economy continues to plod ahead. Our bottom line is that a changing earnings mix within the S&P 500 has masked healthy progress at many companies, one factor supporting the many stocks which are trading within earshot of 52-week highs.

By Richard Skaggs, Senior Equity Strategist and Craig Burelle, Macro Strategies Research Analyst

MALR015978