The third quarter was nothing short of turbulent in the emerging market (EM) asset class, with disruptions largely driven by the US Treasury market and idiosyncratic country risk. A rise in rates followed by a flight to quality hurt emerging market assets. Investors faced market pressures in the second half of September as markets experienced a shift in risk appetite, which led to considerable US dollar strength and a substantial re-pricing of EM securities.

Losses were felt across the EM universe. Local markets were the hardest hit while EM sovereign and corporate credit spreads widened during the US Treasury rally. Although the first half of 2014 generated high returns for most EM assets, the third quarter saw the emergence of winners and losers.

Currency

|

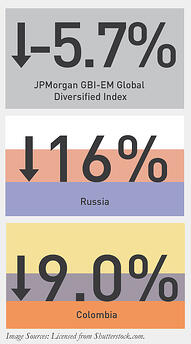

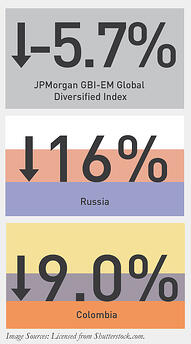

The JP Morgan GBI-EM Global Diversified Index closed down -5.7% for the quarter, erasing virtually all of 2014’s previous gains. Weak EM foreign exchange and the US dollar rally were the main sources of the index’s losses, totaling -4.9%.

|

|

Additionally, geopolitical themes continued to be a drag on performance. The ongoing conflict between Russia and the Ukraine led to both a decline in the Ruble and Russia’s local bond returns, down -16% on the quarter.

|

|

Latin America was also a region hit hard, with Colombia leading the pack, down -9.0%.

|

Sovereign USD Debt

|

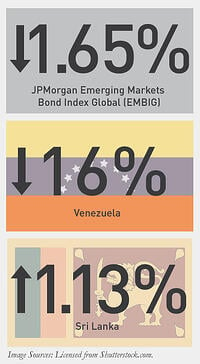

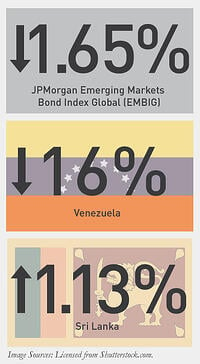

Despite closing the quarter down -1.65%, the JP Morgan Emerging Markets Bond Index Global (EMBIG) remained one of the best performing asset classes within EM. At the end of the quarter, it remained up 7.3% for the year, outperforming both local and corporate debt.

|

|

The worst performers were the high beta names, specifically Venezuela, which over the three summer months closed down -16%.

|

|

Sri Lanka continued to be a top performer, closing up 1.13%. Sri Lanka has been a standout this year, up 11.6%, as investors continue to hunt for yield in stable frontier markets.

|

Emerging USD Corporate Debt

The JP Morgan Corporate Emerging Bond Index (CEMBI) ended the quarter only slightly negative at -.09%. Not surprisingly, the index’s high yield segment underperformed (-1.32%) the investment grade portion (.50%.) Infrastructure and Real Estate were the two top performing sectors, up 1.45% and 1.2% respectively.

Overall, the corporate sector was the most resilient fixed asset class in the third quarter and the turbulent tone should not undercut the asset class’s strong performance, 6.2% YTD at the end of September.

Equities

EM equities fell victim to the markets loss of risk appetite, price volatility and US dollar strength. The MSCI Emerging Markets Index closed down nearly -4%, erasing its 2014 gains.

EM equities fell victim to the markets loss of risk appetite, price volatility and US dollar strength. The MSCI Emerging Markets Index closed down nearly -4%, erasing its 2014 gains.

Surprisingly, frontier equities shrugged off market jitters and continued to rally.

Emerging Market to Watch in 2015: China

As of November 17, 2014, international investors can access 568 stocks listed on the Shanghai Stock Exchange, and mainland Chinese investors have been able to trade 268 stocks listed on the Hong Kong Exchange. The newly implemented Stock Connect program is China’s first major step in reducing restrictions on money flow in and out of the country.

The link has opened up a 4 trillion dollar capital pool to foreign investors and is a milestone in liberalizing Chinese capital markets. This milestone also signals to markets China’s commitment to strengthening its financial sector, bolstering ties to trading partners and improving efficiency within the domestic market.

MALR012642

EM equities fell victim to the markets loss of risk appetite, price volatility and US dollar strength. The MSCI Emerging Markets Index closed down nearly -4%, erasing its 2014 gains.

EM equities fell victim to the markets loss of risk appetite, price volatility and US dollar strength. The MSCI Emerging Markets Index closed down nearly -4%, erasing its 2014 gains.