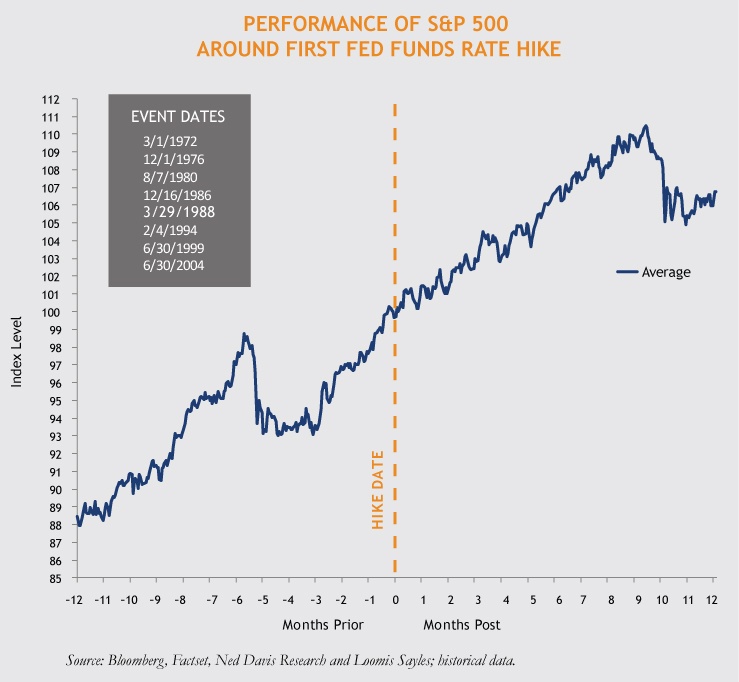

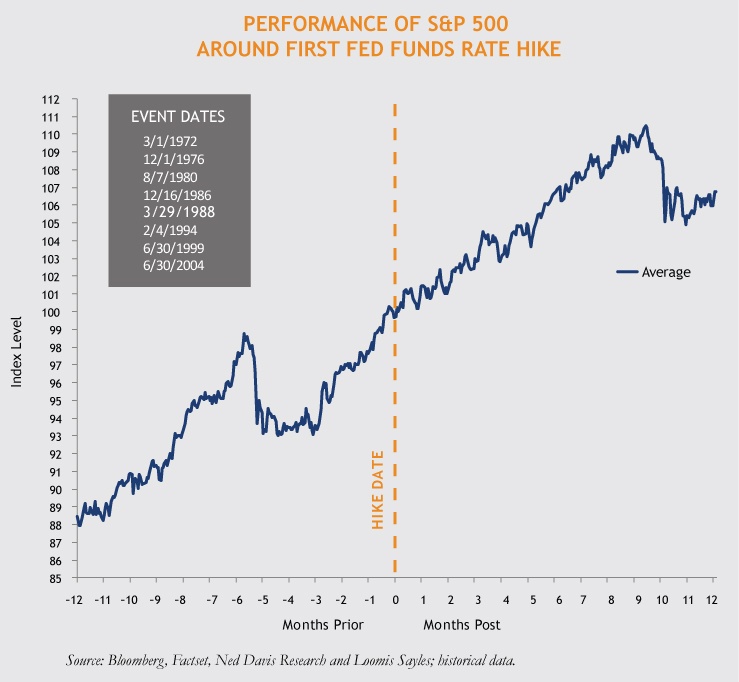

All eyes will be on the Federal Reserve this Wednesday as investors around the world await news on the Fed’s decision to raise (or not raise) the Fed Funds target rate. We believe a rate increase is likely. So, what can we expect from the US equity market?We took a look back at S&P 500 performance over several similar historical points. What we found was that, on average, stocks perform well during the four quarters leading up to an initial rate increase and in the four quarters that follow the initial hike.

It is worth noting that rising interest rates have compressed S&P 500 price-to-earnings multiples in the past. However, current interest rates will be rising from historically low levels during this cycle. Additionally, Fed communication on the pace of tightening after the initial hike should remain an influential factor for US equity market volatility and performance.

MALR014360

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.