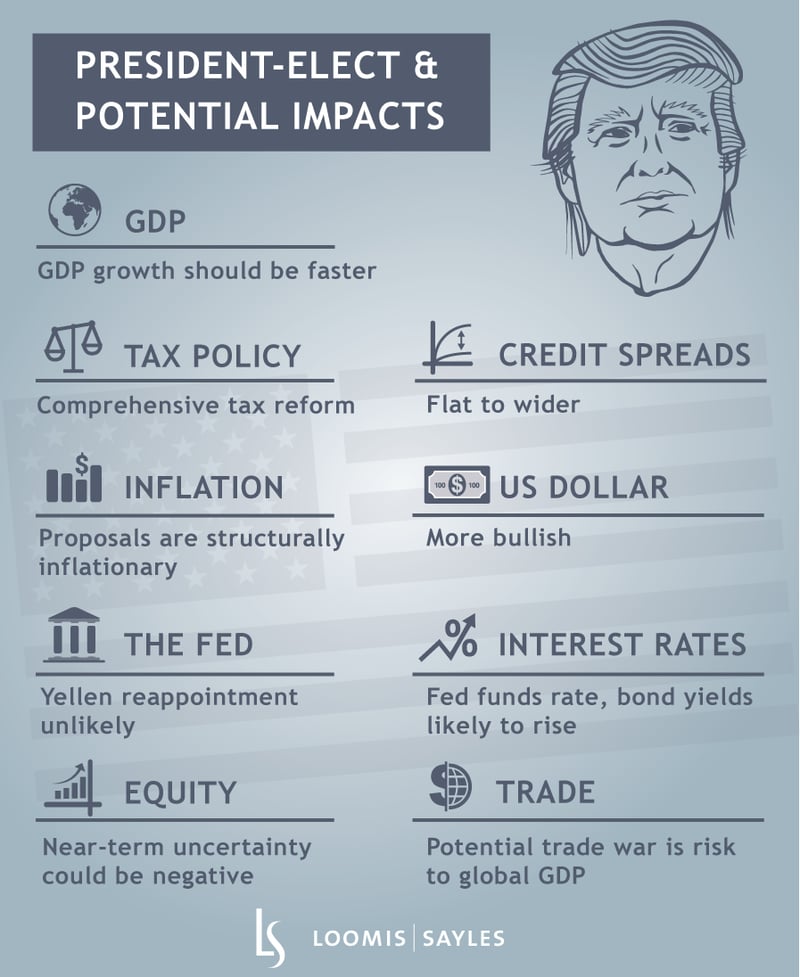

Donald Trump's presidential upset has stunned financial markets, which had heavily discounted a Clinton victory. What might Trump's policy proposals mean for markets and key components of the US economy going forward? The questions outnumber the answers at this stage, but here are our best guesses.

GDP |

The increased level of uncertainty could delay spending in the near term, but overall GDP growth should be faster thanks to tax cuts and infrastructure spending. Trump’s policy proposals call for an aggressive easing of fiscal policy, and we are left with questions on the distribution of tax cuts (will they favor high-income earners with low marginal propensity to consume?) and how they will be funded (up-front spending cuts or delayed cuts?). We believe the major risk of the Trump administration is a supply-side hit to the economy stemming from a potential trade war with higher tariffs and reduced supply of labor due to tougher immigration enforcement. Recession odds increase in the medium term if an initial GDP growth spurt is met with higher interest rates and followed by a negative supply-side shock. Immigration and trade restrictions increase the risk of inflation and a policy tightening error by the Federal Reserve. |

Inflation |

Trump’s proposals are structurally inflationary, but which measures will get passed and implemented is a large unknown. He’s calling for aggressive fiscal policy; an exit of many immigrants (which would put upward pressure on domestic wages and costs); and increased protectionism (a trade war would likely depress growth initially and ultimately raise the cost of global goods via higher tariffs). The supply side of the economy could take a serious hit. |

Tax Policy |

Trump initially talked about $9 trillion worth of cuts over ten years. He later reduced his proposal to $4 trillion; Congress might pass something more reasonable, like $1 trillion. The unknowns on the tax cuts are how they will be funded, their distribution and impact on GDP. On plan, the cuts favor the top income earners who may be less likely to spend. Trump would like to achieve comprehensive tax reform:

So far, he seems to assume revenue loss would be offset by faster GDP growth. |

Federal Reserve |

Trump has already suggested that Federal Reserve Board Chair Janet Yellen would not likely be reappointed when her term ends in February 2018. She may even resign before then. There is likely to be significant turnover at the Fed, with up to five seats turning over, including the vice chair. We could see preference for a more hawkish Fed chair, someone like former Dallas Federal Reserve President Fisher, with a more orthodox view on monetary policy compared to the experimentation and unconventional policies that have ruled since 2008. The fed funds rate should rise faster under Trump. The collision of a more hawkish Fed chair, aggressive fiscal easing with the unemployment rate below 5%, and potential for a negative hit to supply side of the economy are wild cards to watch. |

Interest Rates |

The bond outlook is uncertain because of the extreme policy divergence between a big fiscal boost to growth and a negative supply-side economic shock. Longer term, our bias is that the fed funds rate and bond yields will rise as aggressive fiscal policy easing spurs demand. Loose fiscal measures could then meet potential trade and immigration restrictions, leading to higher inflation. Then we would need to judge how higher interest rates would impact the dollar and the economic outlook. |

Credit Spreads |

From here, spread levels could stay flat or move wider. Increased volatility and uncertainty are anticipated in the near term, and the non-financial corporate sector has continued to add leverage. The Trump victory suggests bolder policies and wider tail risks for the corporate sector. We need to see profits rise relative to debt for credit spreads to remain at current levels. If spreads were to tighten from here, it would probably be on the back of higher Treasury yields compressing the credit spread. |

Equity |

Near-term uncertainty could be negative for equities. The long-term picture is cloudy, but it hinges heavily on the economy and how fast Trump’s prospective tax cuts might speed growth. We’ll watch for tension between a fiscal-driven boost to GDP, higher interest rates and potential for a trade war. In any case, stronger profits and greater investment spending are critical for both economic and profit growth. |

US Dollar |

We have a more bullish outlook for the dollar under a Trump presidency. A key assumption is that loose fiscal policy and tight monetary policy are typically bullish for a currency. Think of the 1980s, when President Reagan’s tax cuts, a defense build up and Volker-led Fed combined to drive the dollar to very high levels. |

Trade |

Trump campaigned on a protectionist, isolationist platform, and tariffs on China and Mexico could become reality. With trade, it is important to think of the supply side of the economy. More trade means more supply, and vice versa. A trade war is the biggest risk to global GDP. Any new president could start a trade war quickly and easily. The fallout would likely hit supply and demand, raise inflation and slow global demand. A trade war could be a significant offset to any fiscal stimulus. |

MALR016160

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.