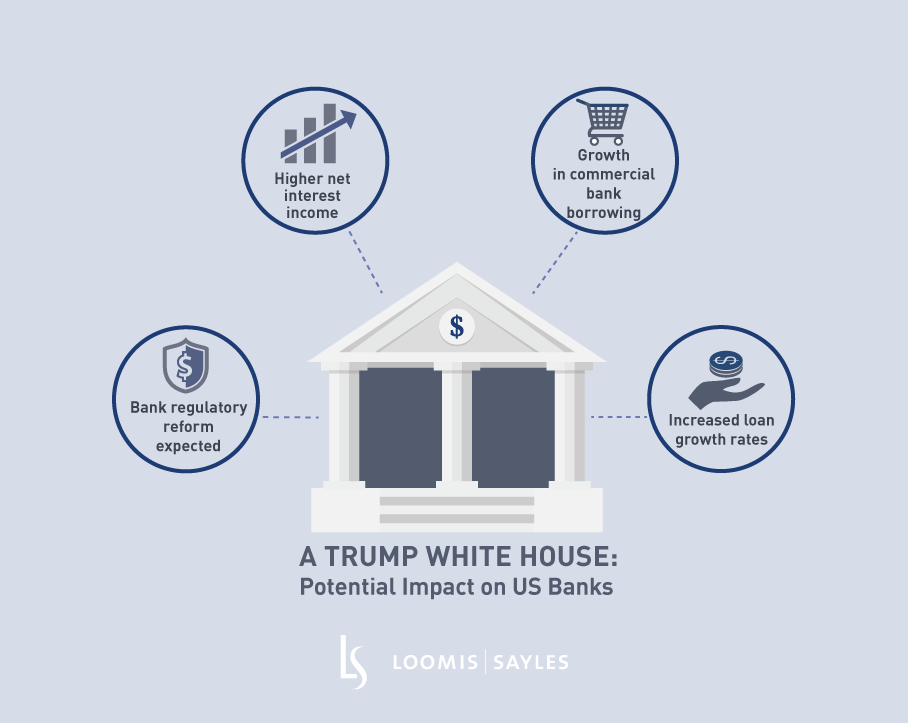

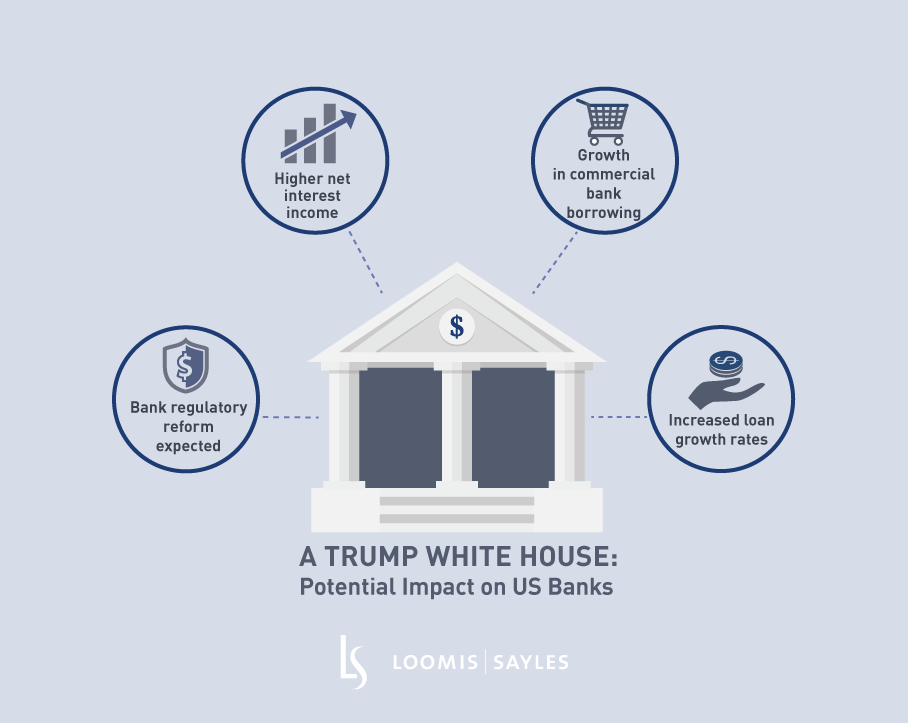

Donald Trump’s presidential victory may have a mildly positive impact on US banks. A change in several economic factors could signal a more positive environment for banks, including:

- Net interest income should experience a boost, as higher interest rates should push net interest margins higher.

- Commercial and industrial loan growth rates are likely to increase with funding for President-elect Trump’s infrastructure projects.

- Commercial bank customers are also expected to increase borrowing as they should benefit from lower taxes and reduced regulations.

In my view, the big unknown is what the Trump administration will do to current bank regulations. Markets are anticipating regulatory reform – but it’s anyone’s guess the extent to which they will be altered.

Reducing the power of the Consumer Financial Protection Bureau (CFPB) would reduce restrictions on many retail financial products (checking/savings accounts, credit cards, auto loans, etc.) and required reporting, which could boost bank revenues and reduce related expenses.

How could this be accomplished? Currently, the director of the CFPB has broad powers to develop regulations and reporting requirements, as well as investigate bank practices. Republicans have long voiced their opinion that the CFPB is too powerful and should be run by a board of directors rather than one individual. As a result, it seems likely that one of Mr. Trump’s first actions may be to reduce the power of the CFPB and its single director, possibly through restructuring the leadership. More control over the CFPB could also be achieved by changing the funding, which is currently done through the Federal Reserve’s budget.

Despite his expressed intention during the Trump campaign to “dismantle the Dodd-Frank Act,” a complete repeal of the Dodd-Frank Act seems unlikely. However, it is reasonable to expect that several aspects of the legislation will be tweaked, such as softening trading and investment restrictions, which could also help boost revenues and reduce expenses.

Specifically, the Volcker Rule has not yet been completely implemented, with some banks receiving extensions until July 2017 to allow orderly sales of prohibited investments and winding down of partnerships and relationships with hedge funds and private equity firms. These requirements, along with some trading restrictions, could be eased. In addition, the Dodd-Frank Act created a Vice Chairman of Supervision position, which President Obama has never filled. An appointment by President-elect Trump of a more moderate regulator could allow some easing of multiple regulations.

Credit Implications

If the stricter capital ratios and new liquidity measures are significantly cut back or the risk on bank balance sheets is allowed to increase, this could be viewed as credit negative depending on the extent to which banks take advantage of relaxed regulations. Overall, while there are many unknowns this early on, I expect the stronger macroeconomic environment and stronger profitability to offset any potential negative impact of changes to regulations.

MALR016182