A combination of spread compression and reduced US Treasury base rates contributed to double-digit gains in the high yield corporate credit sector in 2019. However, unlike many years with similar returns, lower-quality, CCC-rated credits meaningfully lagged their higher-quality counterparts. At this point in the extended credit cycle, investors appear wary about the performance of lower-quality credits.

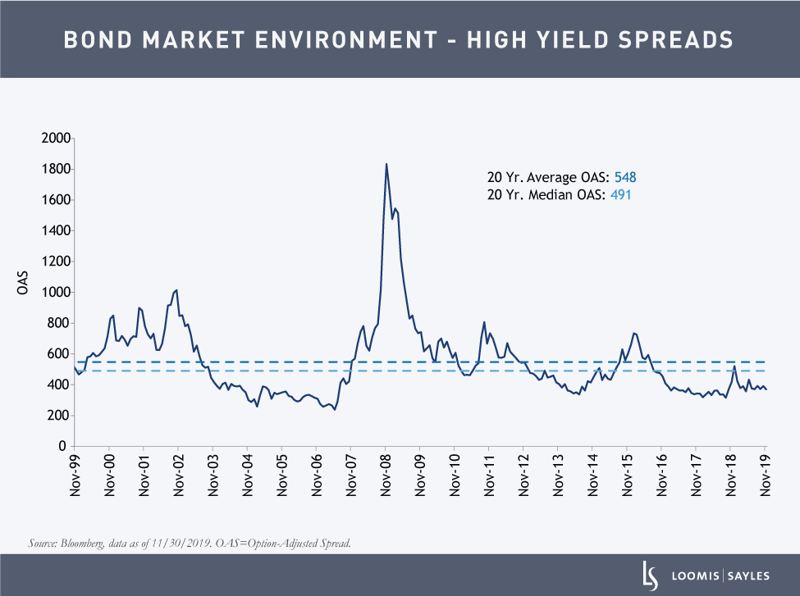

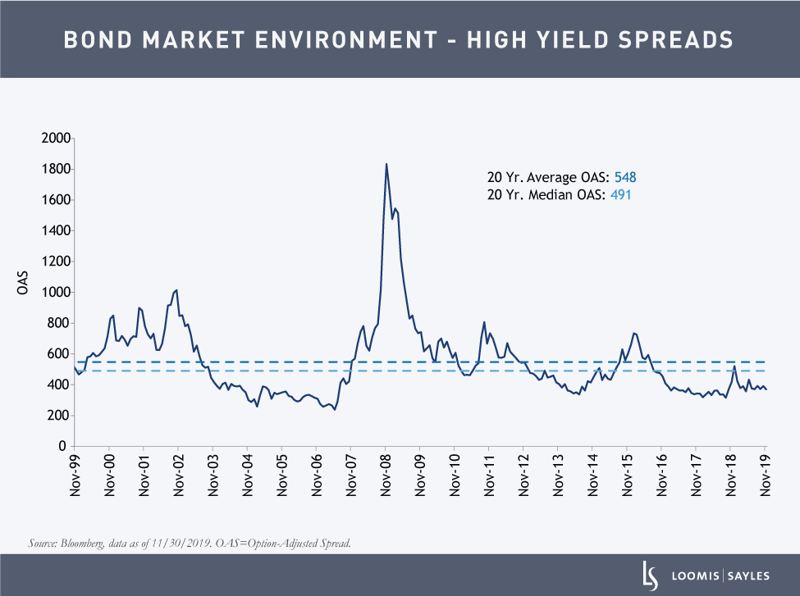

In our view, two competing forces are likely to drive high yield returns going forward. On one hand, corporate leverage remains elevated and the high yield risk premiums[1] are well below where they should be for this point in the credit cycle. On the other hand, demand for US high yield securities remains intact. Globally, accommodative central bank policies have contributed to a glut of negative-yielding assets. Ultimately, we believe investors will continue to favor higher-quality credits in 2020 and we expect modest positive returns for the high yield market.

Factors contributing to this outlook include our forecast for nominal GDP to remain positive, low-single-digit corporate profit growth and relatively steady interest rates in the US. Net new issuance should remain below average and provide a positive technical tailwind to the market. That said, we expect a slight increase in the high yield market’s default rate relative to historical averages. We continue to monitor fallen angels migrating from investment grade to high yield. We believe this space could provide an attractive source of return potential once the credit cycle turns.

Major risks to our outlook include the potential for deteriorating profits, intensifying trade disputes with Europe, a hawkish change in US Federal Reserve policy and uncertainty surrounding the upcoming US election.

[1] High yield risk premium equals current yield spread minus expected losses from downgrades and defaults over the next 12 months.

MALR024653