If quantitative easing (QE) helped lower Treasury yields significantly, will quantitative tightening (QT) have an equal and opposite effect? I don’t think so.

It seems some people may feel uneasy as the Federal Reserve’s QT program, which will shrink the central bank’s $4.5 trillion balance sheet, gets underway. Through QT, the Fed will cap its monthly reinvestments in the Treasury and agency mortgage markets, gradually unwinding a portion of the bond holdings it accumulated during the QE programs that followed the financial crisis.

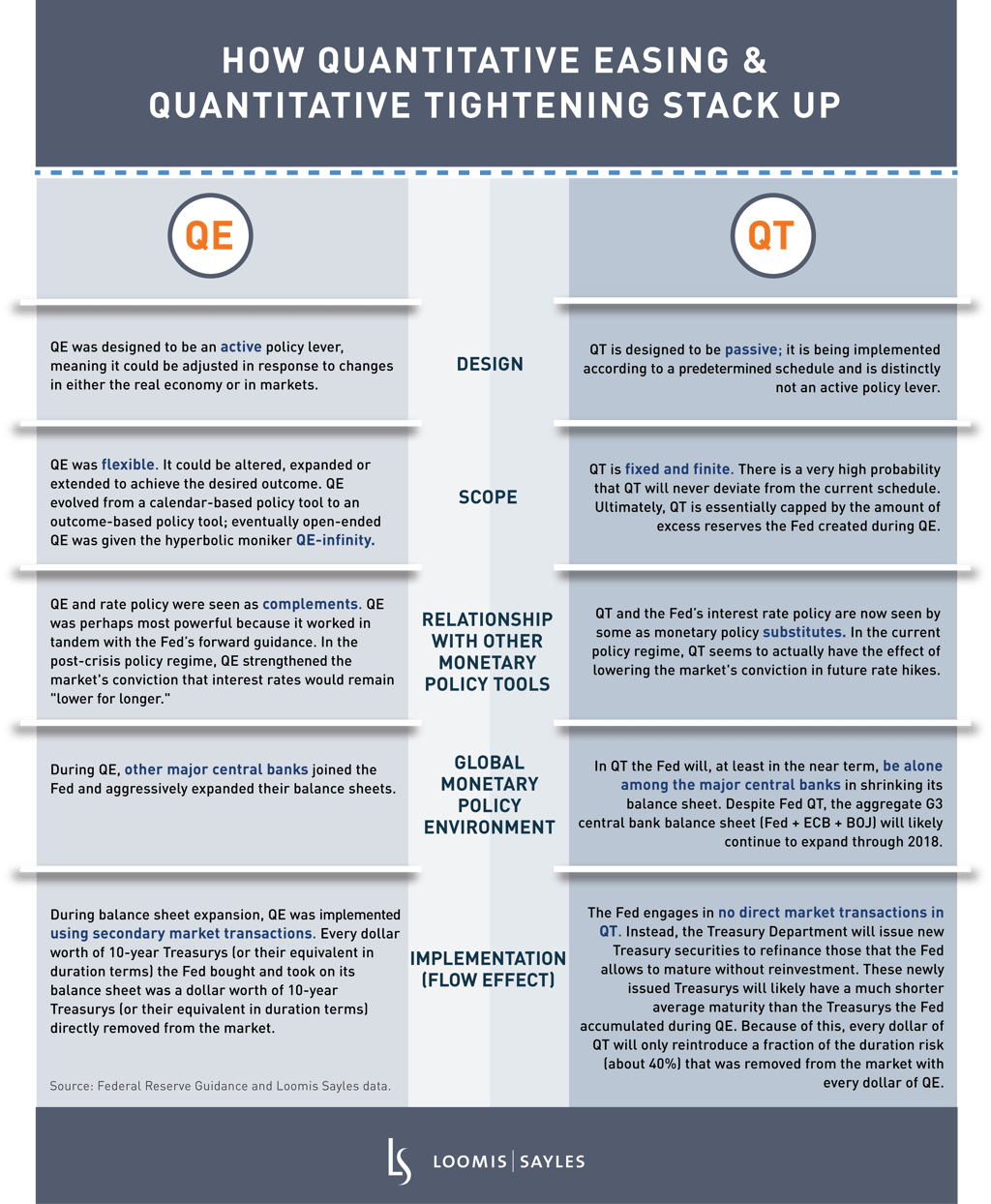

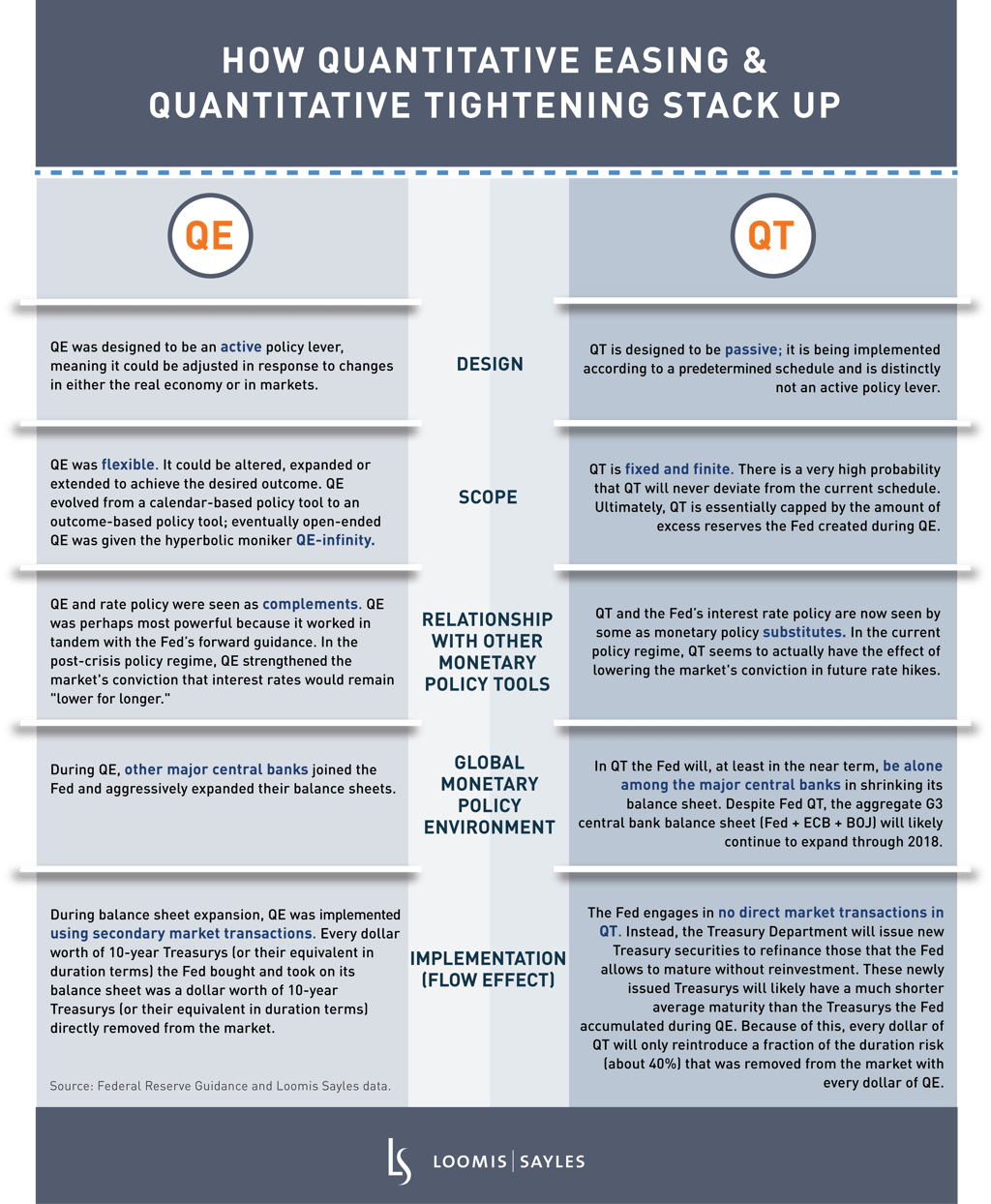

I think QT should have much less of a direct effect on Treasury yields than QE had. Why? In short, QE had a lot going for it—some by design, some by coincidence—that QT doesn't. The policies are meaningfully different in a number of ways. To understand the differences and the implications for Treasury yields, let’s look at how QE and QT stack up.

Are QT concerns much ado about nothing?

The Fed and other central banks have unleashed unprecedented monetary stimulus since 2008, and we are in uncharted territory as that accommodation begins to be withdrawn. This blog only addresses the direct effects that QT might have on Treasury yields. There could be larger indirect effects (for example, a lower level of reserves could affect the cost of borrowing US dollars abroad) for investors to monitor. I consider these indirect effects a “known unknown.” But, as for direct effects on Treasury yields, my view is to be wary of any large estimates. QT is not the bond bear story many seem to be looking for.

MALR020815

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice. Market conditions are extremely fluid and change frequently.