We’ve seen some favorable headlines from China recently, including better-than-expected industrial activity. But the ‘green shoots’ we see in the Chinese economy are not likely to persist and I expect softness to resume in June or July.

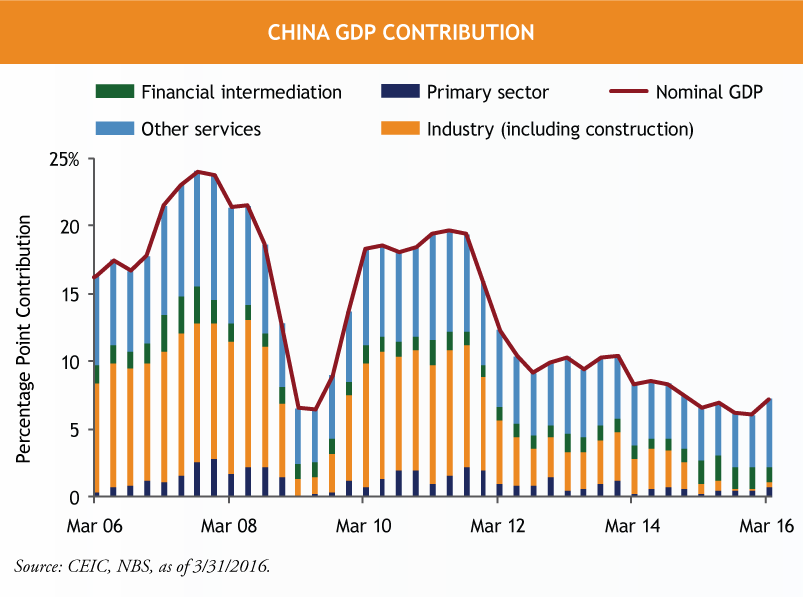

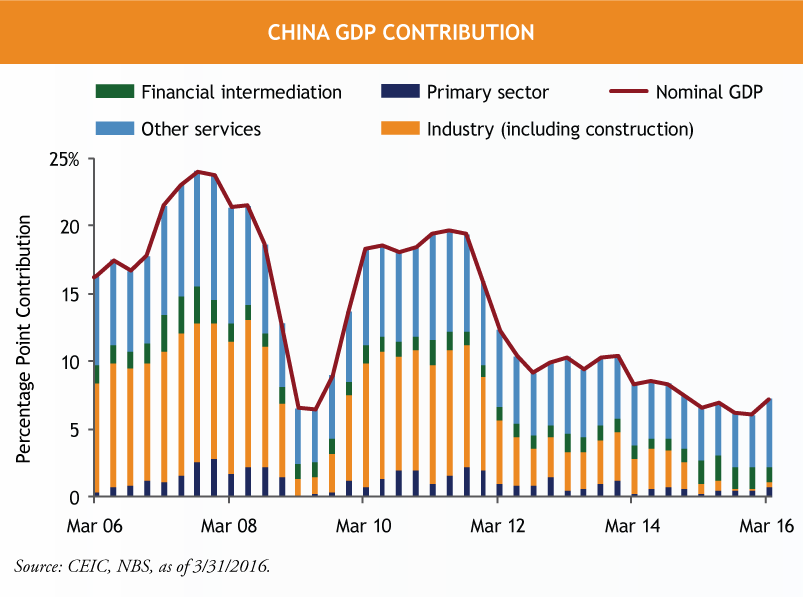

Chinese real GDP growth slowed slightly to 6.7%, from 6.8% in 4Q15, although on a nominal basis, GDP increased to 7.3% y/y in 1Q16 from 5.9% in 4Q15.

March headlines turned heads

- Industrial production jumped to almost 7 % year-over-year in March (from 5.4% in January & February); representing a sharp jump in state-owned enterprise activity, steel production and cement production

- Capital investment rose nearly 11% year-over-year based on a rebound in real estate investment and strong investment by the state-owned enterprises

- Credit financing (known as ‘social financing’ locally) jumped from $182 billion (USD) in February to $271 billion in March, supported by an increase in household borrowing and the continued roll-over in existing debt

Are these trends sustainable?

I expect positive data continue to flow in for month or two as steel restocking, additional quasi-fiscal stimulus and seasonal data distortions continue to impact China’s economic cycle.

But I don’t believe these developments will be lasting:

- Steel restocking is almost complete and oversupply is still a long way from correcting

- The rise in property investment is unlikely to continue based on continued price declines across tier-three cities, smaller cities where most of the overcapacity resides. Additionally, floor space under construction continues to shrink, and land sales remain unchanged from mid-2015

- Policymakers continue to face the policy conundrum over debt and leverage and are likely to hesitate in stimulating the market too aggressively

- While total credit financing moved higher in March, it was driven largely by greater borrowing in the housing sector. This speaks to the rising consumer base in China, the transition to a ‘new’ engine of growth and the robustness of activity by the household sector. While this may help ensure that economic conditions inside China aren’t as dire as outsiders often predict, the rest of the world is largely leveraged to ‘old China’ via heavy industry and construction. And on that front, lending to corporates was soft in March and the People’s Bank of China survey of industrial enterprises suggests an ongoing sluggish outlook

MALR015051

Past performance is no guarantee of future results.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.