The Federal Reserve’s balance sheet has been grabbing headlines recently, and with good reason: the Fed’s three massive bond buying programs, used to stimulate the US economy during and after the 2008 financial crisis, have left the central bank holding trillions of dollars worth of Treasury and agency mortgage-backed securities (MBS).

Now that the US economy looks on track, the Fed has begun to raise interest rates, and it wants to begin normalizing the balance sheet “relatively soon” by capping the amount of money it reinvests in mortgages each month.

Some investors, wary of how the market may react once the Fed withdraws, have already pulled back from agency MBS. Won’t things only get worse once balance sheet normalization is officially underway? Not necessarily.

I believe agency MBS can modestly outperform US Treasurys over the next 6 to 12 months. Here are three reasons why:

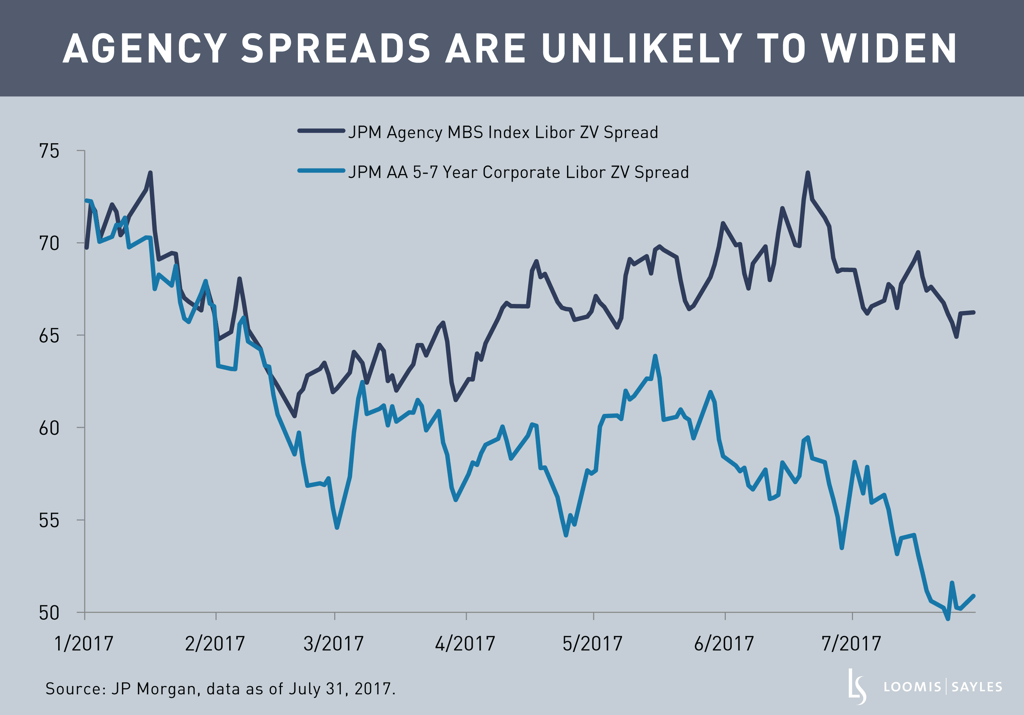

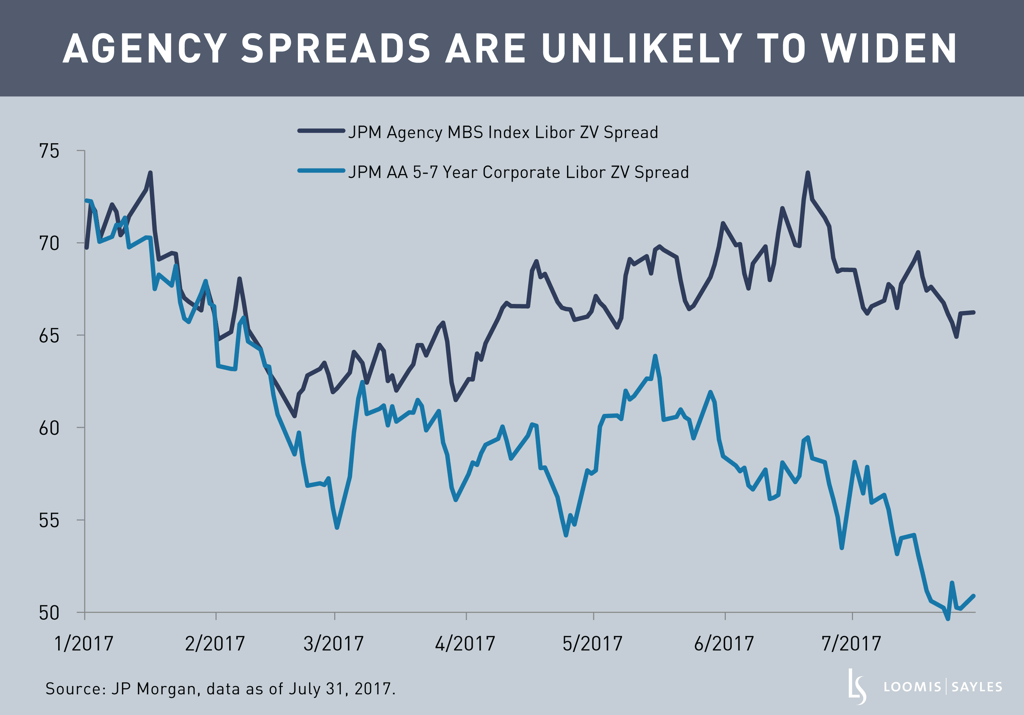

1. “Normalization” is already baked in: The Fed has telegraphed a very benign approach for reducing its MBS principal reinvestments, and MBS spreads have already widened to price this in. A look at the spreads offered on agency MBS and high-quality maturity-matched AA corporates illustrates this point. Both asset classes are sensitive to interest rate changes and offer a yield advantage over Treasurys, yet the corporate spread has tightened since the beginning of the year while agency MBS has lagged. I believe agency spreads are unlikely to widen substantially from here, and they could tighten.

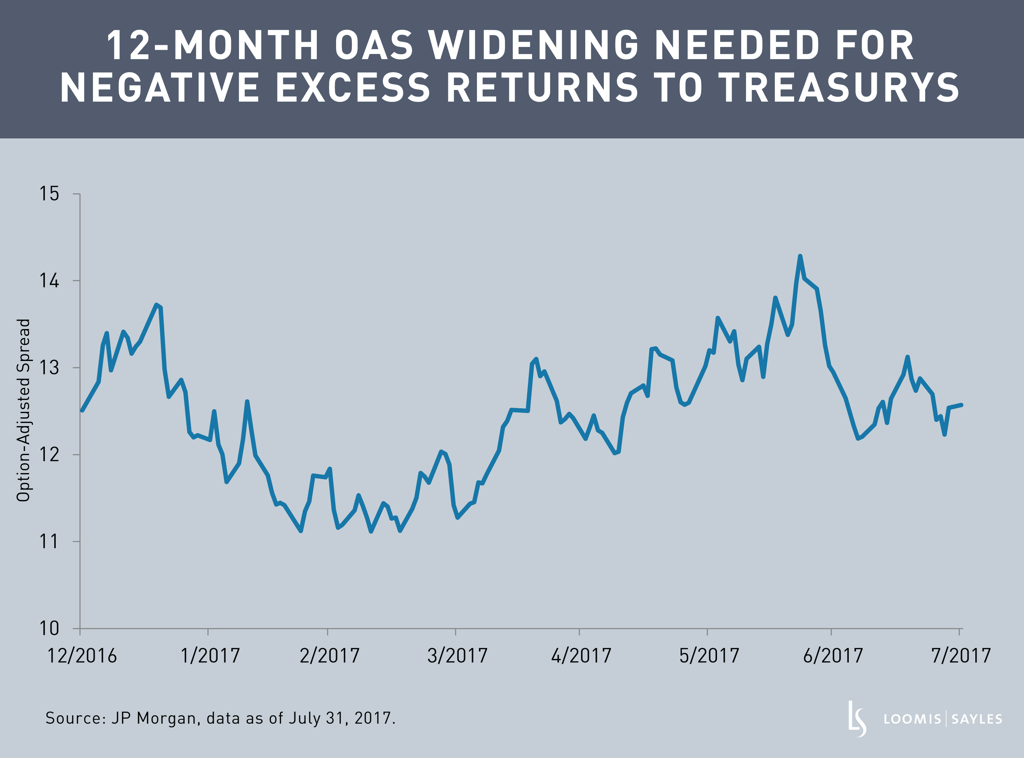

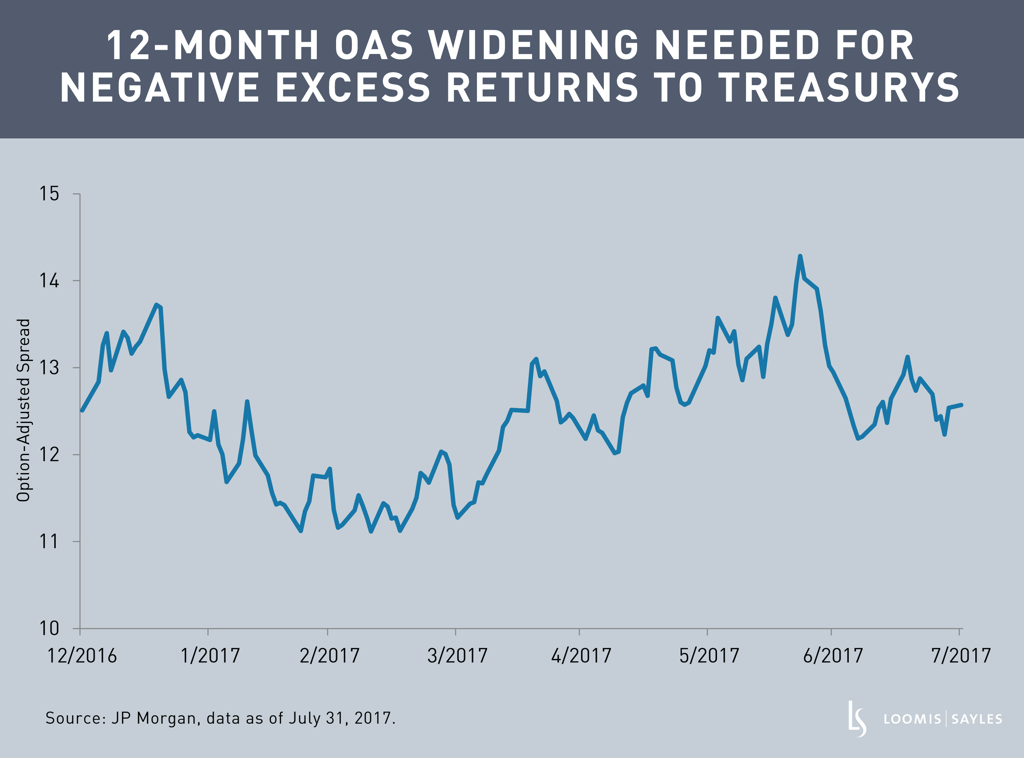

2. Agency MBS currently have a yield advantage: Currently, agency MBS provide a yield cushion versus Treasurys. As shown below, option-adjusted spreads (OAS) on agency MBS would have to widen by almost 12 basis points over 12 months before the sector would underperform Treasurys. The Fed has been very clear about how it plans to withdraw from the mortgage market, and it has hinted strongly at the timing. This transparency has mitigated uncertainty, so I do not foresee a continued and sustained OAS widening.

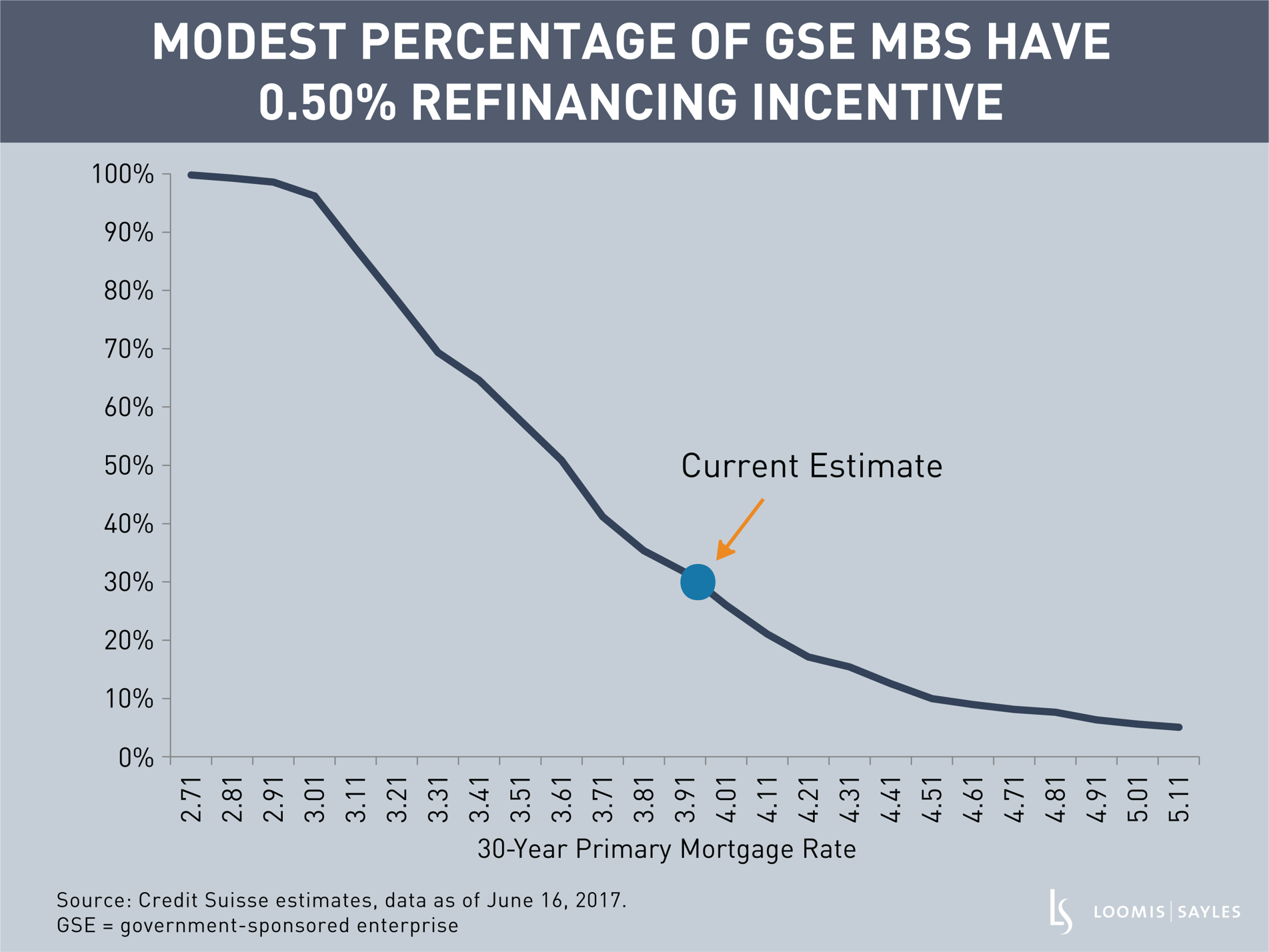

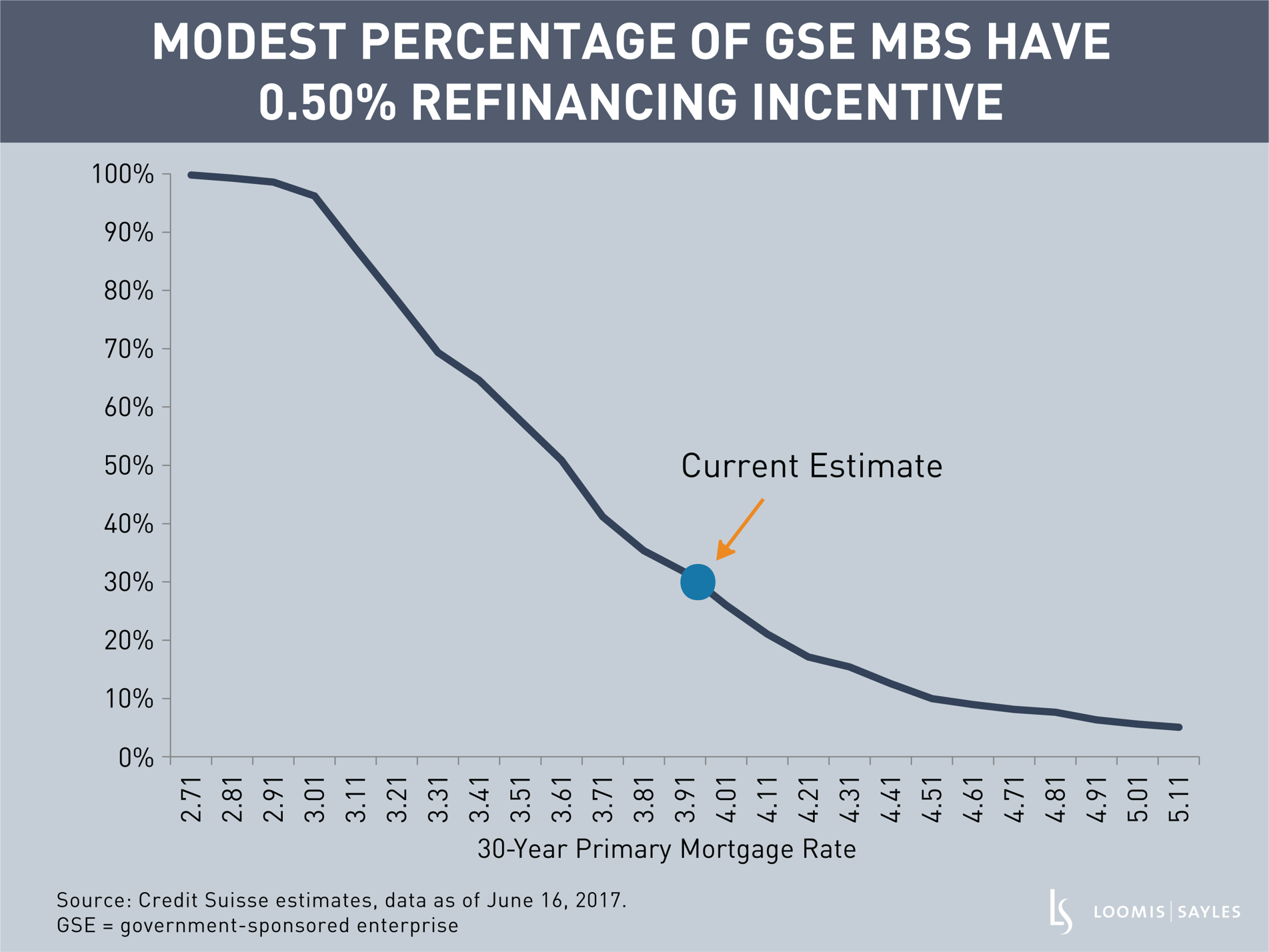

3. A refinancing wave looks unlikely: Given the current level of interest rates and mortgage rates, a mass refinancing in the agency mortgage space looks unlikely. Currently, only a modest percentage of mortgages have a 0.50% rate incentive to refinance. In my view, it would take a sustained, prolonged decrease in rates, with the 10-year Treasury rate at 1.5%, before a significant refinancing event would take shape.

Past market experience is no guarantee of future results.

The index does not represent the actual or expected future performance of any investment product. Indexes are unmanaged and do not incur fees. It is not possible to invest directly in an index.

MALR020535

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice. Market conditions are extremely fluid and change frequently.