Things are changing in subprime auto lending. Subprime auto lending is increasing and credit performance is worsening. However, we believe it is still within historical standards and this negative trend shouldn’t automatically be perceived as a threat.

In this context, let’s look at two key data sets to approach the current narrative around subprime auto lending.

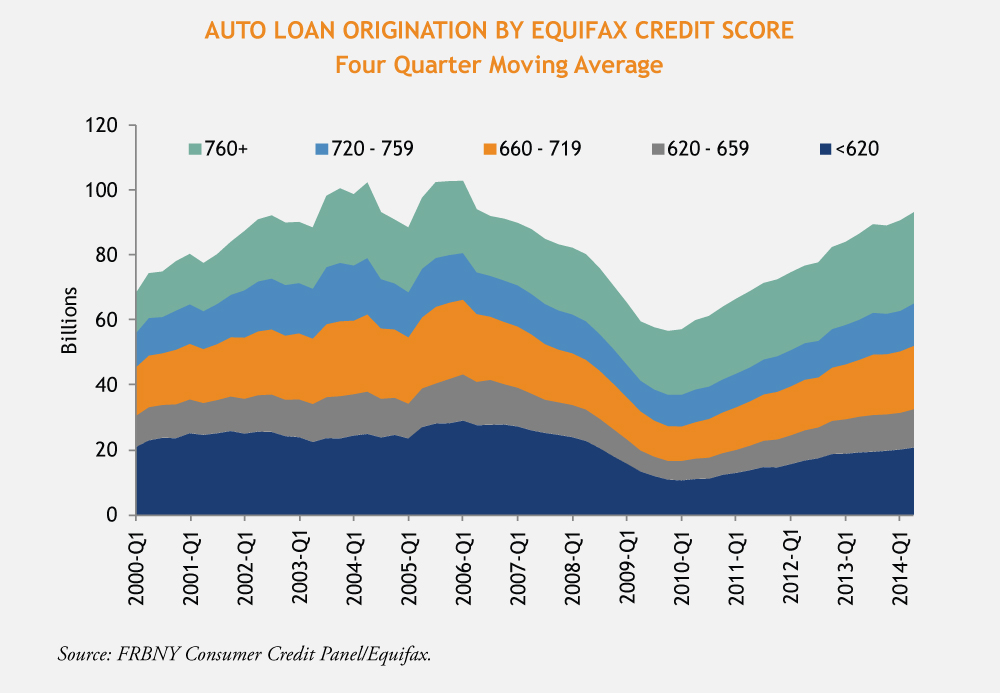

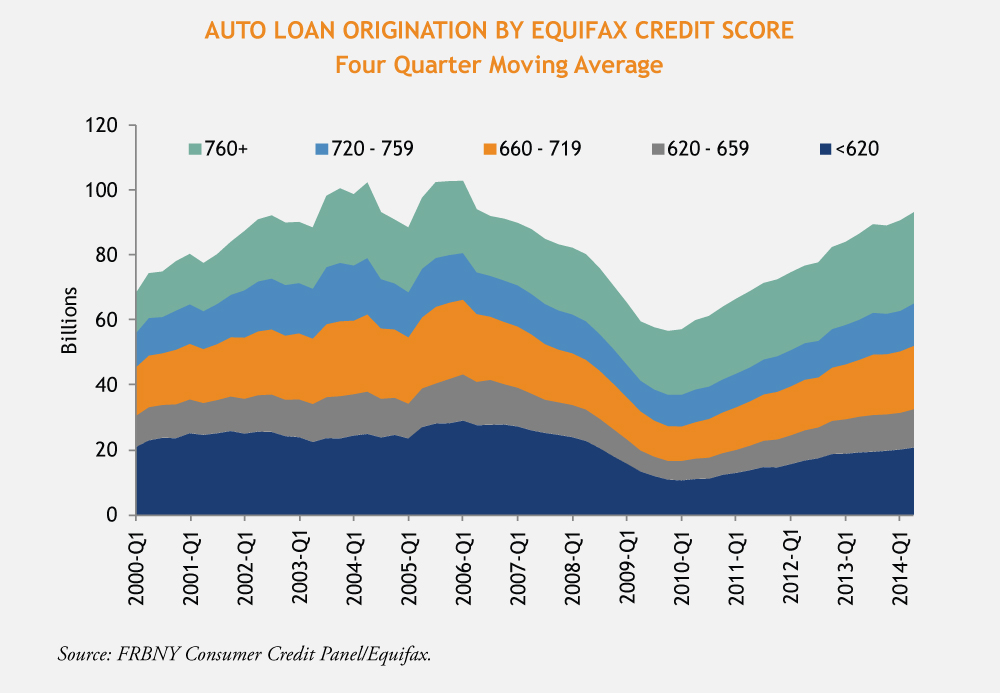

1. Auto Loan Origination by Equifax Credit Score

Much ink has been spilled over increased origination volumes in subprime auto. Although there is more auto loan origination to borrowers with an Equifax score below 620 than four years ago, there is still less origination volume in this space than in 2006, which was the peak of subprime home mortgage origination.

Q2 2014: $20.6 billion

Q2 2010: $10.9 billion

Q2 2006: $27.5 billion

There is also less auto loan origination volume associated with the “below 620” borrower than in Q4 2000, far before the terminology “subprime mortgage” had entered popular discourse. One could argue that subprime auto loan originations could easily be greater than 2000 levels through inflation alone….but they aren’t.

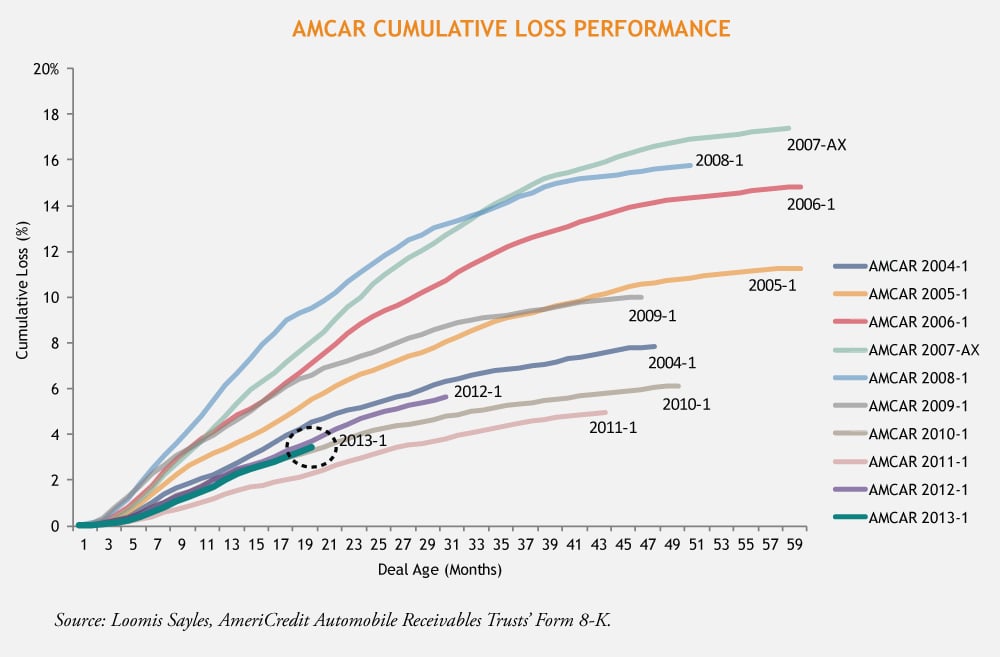

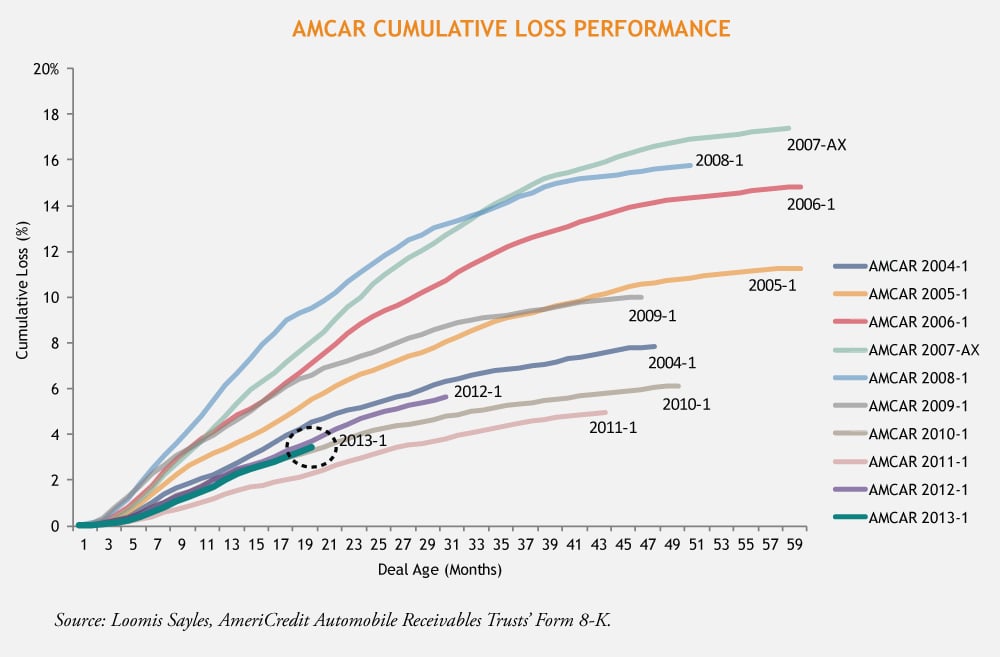

2. Credit Performance of Subprime Auto Loans

While it’s common knowledge that subprime auto performance is deteriorating from what was fantastic credit performance in 2011 and 2012, it’s not as common to place current performance in the context of other years.

The performance of GM Financial’s subprime auto ABS (associated with the Bloomberg ticker AMCAR) provides a useful benchmark for how subprime auto loans have performed across time.

This chart is being shown for illustrative purposes only.

Credit performance in subprime auto loans is worsening, but it’s still better than it’s been in the past. In the chart above, you can see that the 2013 vintage of AMCAR is performing worse than 2011, but better than many other years.

Current performance is very good by the standards of 2007 and 2008, and good by the standards of the 2004 and 2005, both of which ended up being benign economic environments.

Conclusion

The claim that a situation is becoming worse is different from the claim that it is becoming threatening. It is important to interpret this change meaningfully - frameworks that classify threats can assist in effective action.

We take the view that although things are “getting worse” in subprime auto loans, the situation is still within historical tolerances.

- While subprime auto loan origination is increasing, origination volumes of auto loans with an Equifax score below 620 remain lower than those between Q4 2000 and Q4 2007.

- Credit performance of subprime auto ABS (as proxied by AMCAR) is deteriorating, but remains better than many years in recent memory.

This is no argument for complacency. The future could always be different than the present, and we continue to monitor the market with a watchful eye.

MALR012449

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice. Market conditions are extremely fluid and change frequently.