What do rate hikes portend for the equity markets? Let’s do the numbers.

We examined the past eight Fed rate hike cycles since 1972 to see how stocks performed as rate hikes were implemented. Based on history, it appears equity investors have little to fear in the early stages of rate increases. As a result, a rate hike would not present a material obstacle to our ongoing constructive view of equity prospects over the next 12-18 months.

It’s about timing

Rate hikes usually commence with the economy doing well; otherwise there would be no reason to put rate hikes into action. This suggests that business conditions at the time of initial hikes are for the most part, favorable -- with revenue and earnings growth making steady progress.

Occasionally, rate hikes commence under late cycle conditions with capacity utilization at high levels and inflation beginning to accelerate. These "late cycle hikes" generally present more challenges for equity investors.

In today's case we have tame inflation and slack – unused capacity – in both the domestic and global economies. We believe business conditions are likely to remain favorable in the early stages because:

- We are starting from very low Federal funds rate (close to zero)

- Long-term interest rates are also very low

- The cost of debt for corporations is likely to remain attractive until rates move a great deal higher than where they are today

- Corporate earnings are expected to continue to rise at a deliberate rate

If business conditions deteriorate, we would expect the Fed to curtail rate hikes and take a wait-and-see approach.

What can history tell us?

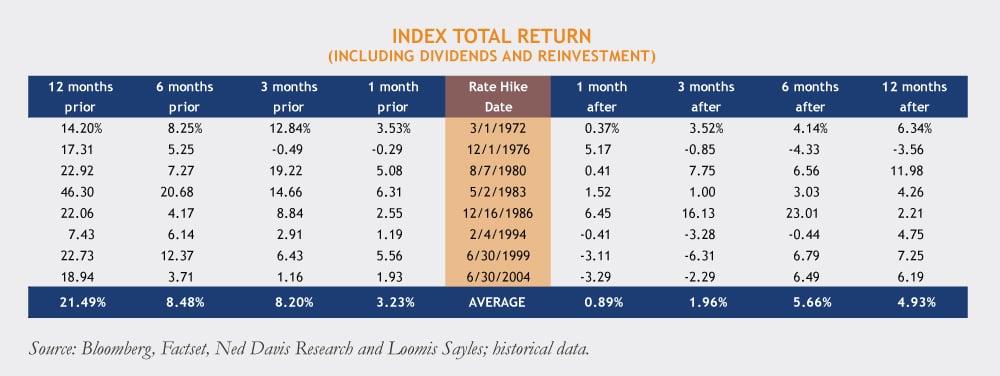

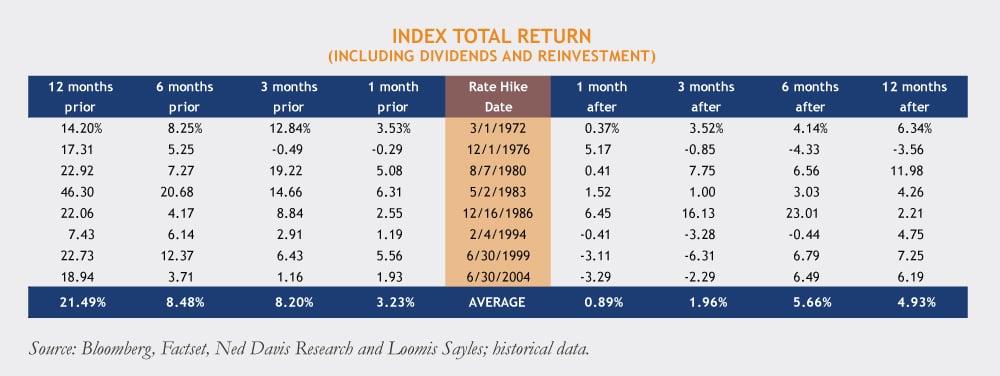

For the most part, stocks have performed well in the quarters before and after an initial rate hike.

Before

On average, the S&P 500 has risen by a very healthy 21.49% in the one-year period before an initial rate hike. Six-month, three-month and even one-month returns are also positive on average, with almost no negative returns prior to the initial hike. This is logical, affirming that rate hikes begin when the economy is on solid footing and business conditions are favorable.

After

Examining periods after initial rate hikes, we observe several cases of relatively modest declines in the S&P 500, in the -3% to -6% range, although there are other examples of gains continuing after hikes. If we look out six months, on average stocks have returned 5.66%, and looking out 12 months, we see an average gain of 4.93%.

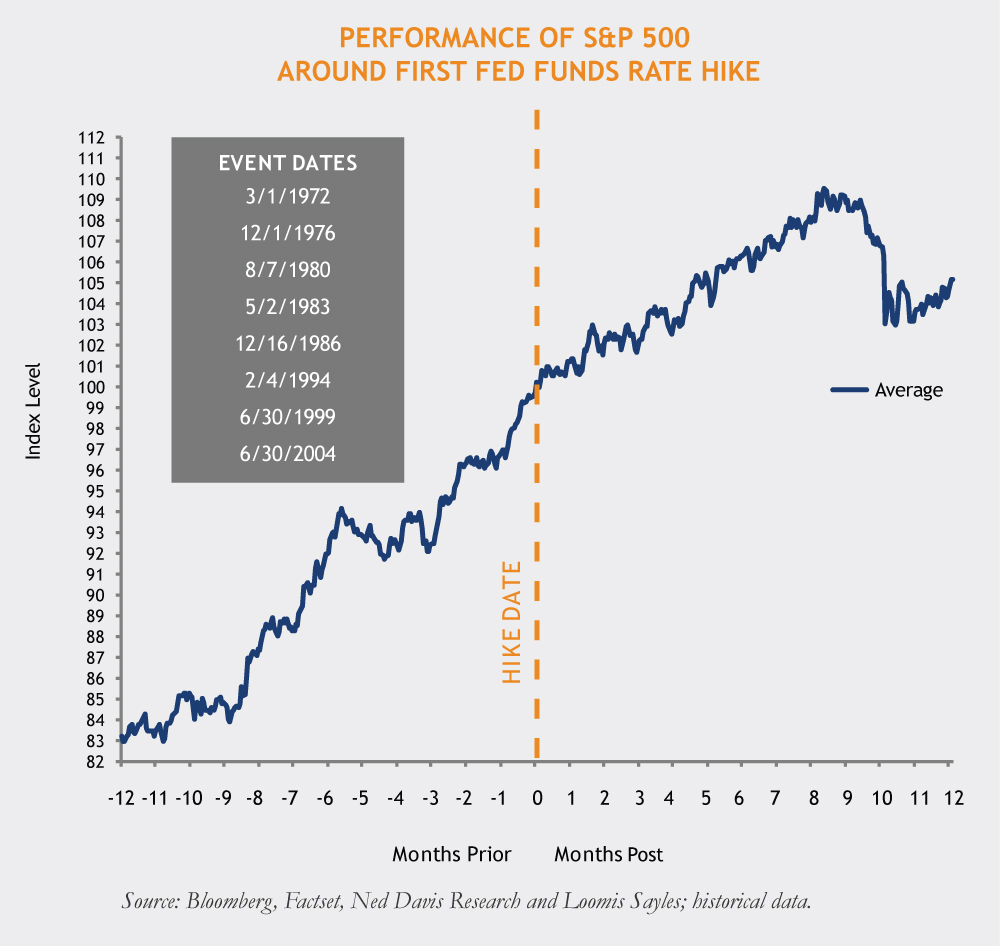

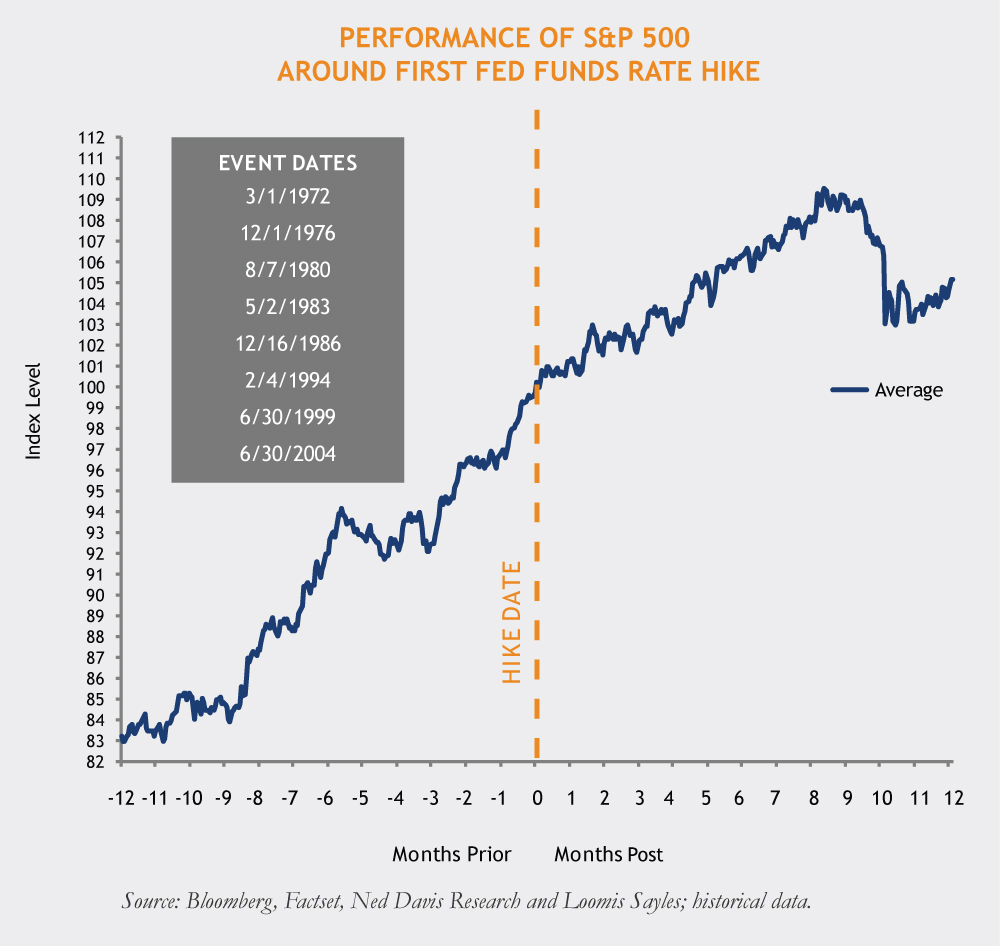

The chart below is a performance composite of the S&P 500 averaged over the eight cycles. While there is some volatility, it is not out of the ordinary and the aggregate trends have been positive.

As rate hikes accumulate, and when the Fed moves to a policy goal of slowing an overheating economy, this would not be such a generally favorable environment for corporate earnings and equity valuations. A sharp slowdown in growth or even recession has been associated with stock market declines of 15%-20% or more.

We believe we are far removed from any set of conditions which would cause the Fed to apply the brakes hard. And this is further supported by the fact that Europe and Japan, for example, are growing slowly and continue to pursue monetary stimulus.

The Fed is focused on the overall health of the economy and we believe that rate hikes, whenever they begin, will be carefully paced. Past cycles suggest stocks can perform positively on average, both prior to and after to initial rate hikes. In our view, there is no reason to expect aggressive Fed tightening action in the next few months. While that may change looking out a few quarters, we think that is a low probability proposition based on our forecasts. A potential initial rate hike in the coming quarters should not be a material obstacle to our ongoing constructive view of equity prospects over the medium term.

By Richard Skaggs, Senior Equity Strategist and Craig Burelle, Macro Strategies Research Analyst

MALR012534

Indexes are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Past performance is no guarantee of future results. Investment return and principal value may fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice. Market conditions are extremely fluid and change frequently.