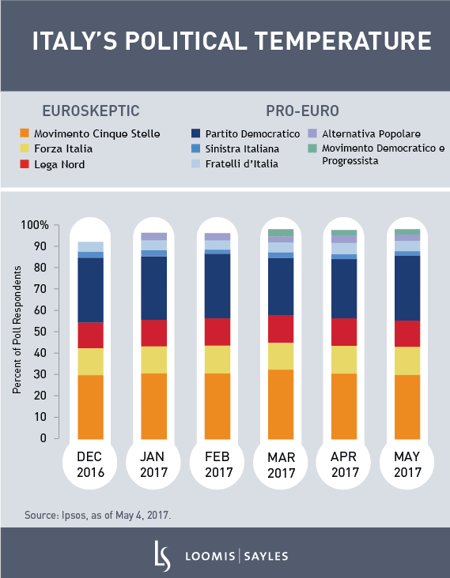

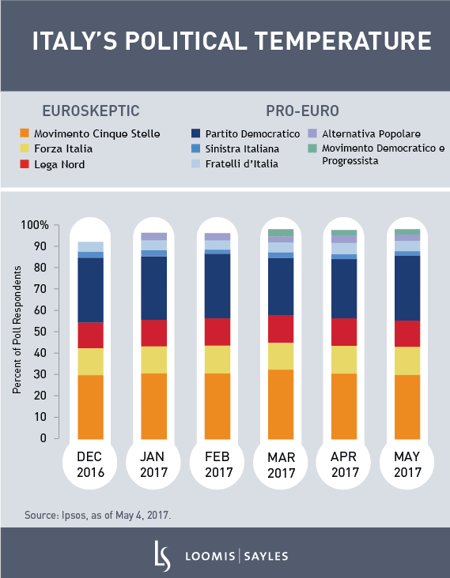

Markets breathed a sigh of relief as centrist Emmanuel Macron won the French presidency on Sunday, May 7. Despite the seemingly good news, Italian bonds sold off as investors prepare for turbulent Italian politics ahead. Italy, with its lagging economic growth and chronically ill banking sector, is due to hold its next election before May 2018, and the total combined poll numbers for political parties with anti-euro stances is above 50%.

There is a meaningful chance of an anti-euro government coming to power in Italy. Parties on the right side of Italy’s political spectrum, including Silvio Berlusconi’s Forza Italia, are increasingly adopting anti-euro platforms. The anti-euro Movimento Cinque Stelle (M5S) party is neck-and-neck with former Prime Minister Matteo Renzi’s center-left Partito Democratico (PD). Renzi’s government collapsed in December after the population rejected his constitutional reform, and a progressive left movement subsequently broke away from the PD. Renzi recently reasserted leadership of the PD in a party primary, but he returns as a damaged leader with a weaker mandate.

There is a meaningful chance of an anti-euro government coming to power in Italy. Parties on the right side of Italy’s political spectrum, including Silvio Berlusconi’s Forza Italia, are increasingly adopting anti-euro platforms. The anti-euro Movimento Cinque Stelle (M5S) party is neck-and-neck with former Prime Minister Matteo Renzi’s center-left Partito Democratico (PD). Renzi’s government collapsed in December after the population rejected his constitutional reform, and a progressive left movement subsequently broke away from the PD. Renzi recently reasserted leadership of the PD in a party primary, but he returns as a damaged leader with a weaker mandate.

Both the timing and terms of the Italian election are uncertain. Some leaders have pushed for earlier elections, while others are more inclined toward later elections in hopes that the ongoing economic upswing will bolster their election odds. Parliament may amend electoral law in coming months in an effort to reduce the likelihood of a M5S government, although legislators have not made much progress in this direction recently. Recall that Italy’s last election, in February 2013, produced a hung parliament and market pressure that lasted until a coalition government was finally formed in April 2013.

The upcoming Italian election could produce an anti-euro government, but it’s more likely to produce a feeble coalition government with limited ability to implement necessary structural reforms. Either way, Italy’s high public debt, sickly banking system and a less accommodative European Central Bank mean investors should prepare for potential renewed market stress.

MALR017320

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice. Market conditions are extremely fluid and change frequently.

There is a meaningful chance of an anti-euro government coming to power in Italy. Parties on the right side of Italy’s political spectrum, including Silvio Berlusconi’s Forza Italia, are increasingly adopting anti-euro platforms. The anti-euro Movimento Cinque Stelle (M5S) party is neck-and-neck with former Prime Minister Matteo Renzi’s center-left Partito Democratico (PD). Renzi’s government collapsed in December after the population rejected his constitutional reform, and a progressive left movement subsequently broke away from the PD. Renzi recently reasserted leadership of the PD in a party primary, but he returns as a damaged leader with a weaker mandate.

There is a meaningful chance of an anti-euro government coming to power in Italy. Parties on the right side of Italy’s political spectrum, including Silvio Berlusconi’s Forza Italia, are increasingly adopting anti-euro platforms. The anti-euro Movimento Cinque Stelle (M5S) party is neck-and-neck with former Prime Minister Matteo Renzi’s center-left Partito Democratico (PD). Renzi’s government collapsed in December after the population rejected his constitutional reform, and a progressive left movement subsequently broke away from the PD. Renzi recently reasserted leadership of the PD in a party primary, but he returns as a damaged leader with a weaker mandate.